To find a home are a pricey and you can risky activity, however, building your own house is actually a far more astounding performing. It needs a keen thorough a number of opportunities, such as for example finding the optimum designer, protecting permits, referring to work, and you can projecting your own expenditures and you can home loan repayments. Its an economic and you may intellectual burden, nevertheless the good news would be the fact so it monetary load can be alleviated with the aid of a construction financing.

Structure funds are specifically made to improve individuals having projects, be it strengthening a house off scratch otherwise renovating an established structure. But not, it is vital that you first make a deep knowledge of what precisely a property mortgage was and you can what the demands try.

Construction-To-Permanent Loan

Which mortgage money the construction away from a property. Since the design is completed, the loan gets transformed into a fixed mortgage. This can be good for people which need to store into the financing settlement costs and you can lack home loan investment so you’re able to borrow collateral finance.

Construction-Only Loan

This is a primary-name, changeable rates loan which is used to conclude the building off a venture. Because building processes is done, the mortgage should be paid-in full otherwise refinanced towards an effective home loan. Individuals just who currently have a critical Hudson installment loans amount of money necessary for the construction or those who intend to pay into the selling from a previous property choose this financing. Yet not, these can ultimately getting costlier if you need a home loan as this requires a few separate financing transactions as well as 2 fee sets.

Owner-Builder Financing

These types of mortgage brings try truly designed to the owner creator instead than simply a third-people company. The dog owner will act as her standard builder. Owner-building money was solely available to home owners that may confirm that they have experience in framework or has a housing permit and you may the new solutions necessary to adhere to building codes.

Renovation Loan

That one is one of exactly like a timeless home loan. A remodelling mortgage talks about the cost of to purchase a property and undertaking big reount utilizes the brand new forecast value of the newest possessions shortly after home improvements. Those who get properties about to flip these with extreme home improvements sign up for that it mortgage. Another option are a finances-aside re-finance, where a citizen would sign up for a new mortgage at the a higher matter than just the current loan and you may located that excessive for the a lump sum payment count.

Stop Financing

This type of relate to the new homeowner’s mortgage following build is concluded. A construction mortgage try paid back once the strengthening is actually built, and after that you will simply be left with your typical home loan to pay off.

Just how to Safer A housing Loan

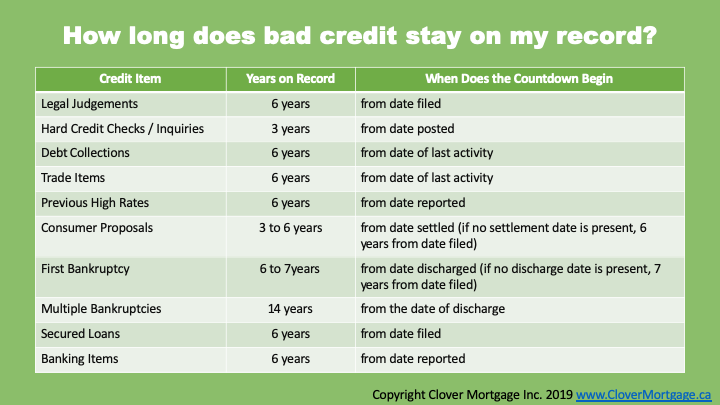

Framework financing are considered highest-exposure financing as they are unsecured. This is why the process is more in depth than just the common mortgage loan. To reduce relevant threats, lenders need the individuals to own a top credit score. If you’re considering implementing, was boosting your score to increase your chances of securing the newest loan. In addition to a stronger credit rating, you also need to own an acceptable earnings to deal with subsequent costs. Attempt to bring your own lender which have files concerning your income on the family savings.

The lender may also calculate the borrower’s loans-to-income proportion. A minimal DTI implies that you have a great deal more disposable income to have your loan money. Near to, the financial institution requires a detailed membership of your own funds and you will plans in addition to approval of the builder. You will need to build a down-payment with a minimum of 20%; yet not, many lenders require ranging from 25% to 31%.

Its on the best interests to cross-have a look at multiple structure loan companies to acquire details about the certain applications and you may procedurespare the build mortgage pricing, terminology, and you will down-payment standards to ensure you get the most suitable contract for your state. If you find yourself up against issue to find a lender that’s happy to help you, you might try contacting credit unions and you will reduced local finance companies because they are more flexible with regards to criteria.

Endnote

Design is actually a fees-intensive endeavor, and incredibly couple will perform they versus extra financial help. A casing loan try a convenient choice to find the finance necessary for house, work, procedure, or any other building-related expenses. Earliest, you should thoroughly know what which entails and also the brand of financing your specific opportunity requires. Once you’ve received the borrowed funds, it’s best to just do it having a houses management company to ensure you spend new covered finance truthfully. Otherwise, inexperienced framework efforts often just make your currency see waste.