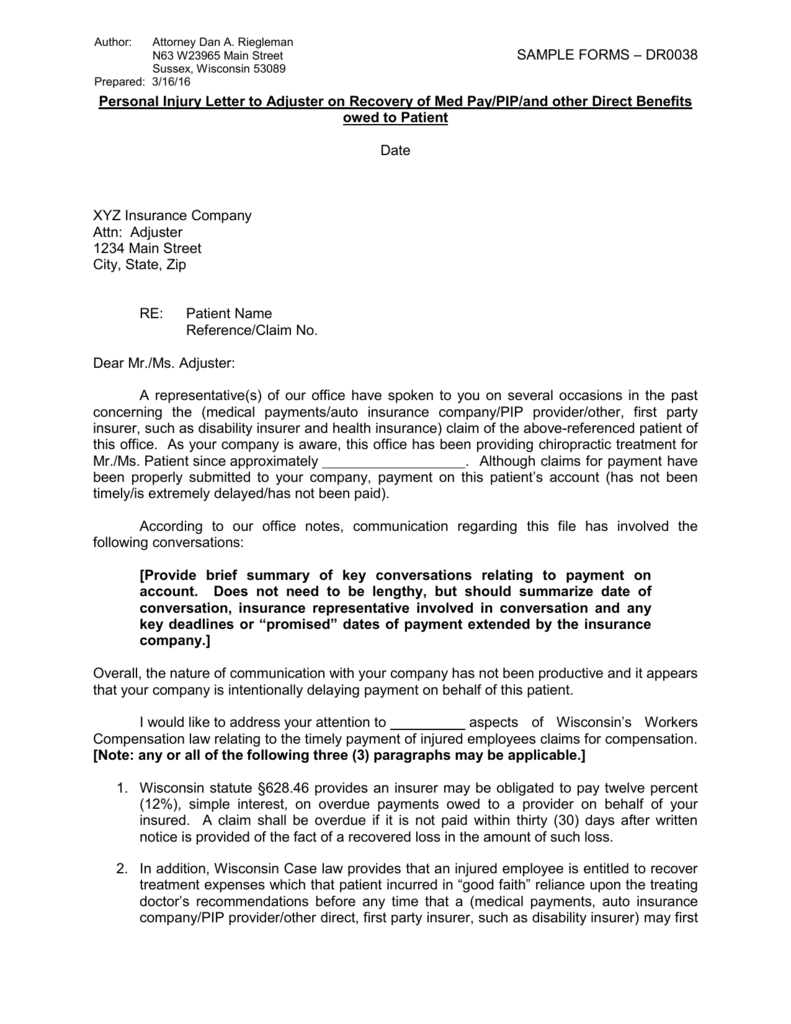

- General estimate

- Fast-requires only 10 minutes

- Monetary info is Not verified

- Borrowing isnt featured

- Guarantee in order to lend, subject to house testing

- A great deal more during the-depth-requires at least 48 hours

- Economic information is affirmed

- Borrowing was featured

When you’re ready to invest in another type of family, perhaps one of the most very important factors for your requirements, their real estate professional and you can providers is how much house you can afford. If you money our home with a home loan, you really need to learn of a loan provider what kind of cash you could use. Additionally, you will want to determine what fee count is comfy to you personally inside your full month-to-month finances. Simply because you might acquire a specific amount doesn’t invariably suggest you need to spend this much.

Pre-Degree

If you choose to wade our home loan station and require an instant, basic idea of your spending strength, taking a mortgage pre-qualification is a great initial step. Being pre-accredited function you have told your financial basic information about the assets and you may money and you will they usually have come back that have an offer of how far domestic you can afford. One to guess isnt guaranteed by lender while they most likely have not viewed proof of your money or drawn the borrowing up to now. Consider pre-degree because the an amount borrowed you may want to be eligible for For folks who pertain. The main benefit of pre-certification is actually speed. You can buy pre-licensed over the phone in as little as ten full minutes. But not, if you wish to create a meaningful impression into real estate representatives and you will suppliers, you’ll need to score pre-approved.

Pre-Approval

Being pre-recognized to own borrowing to have a mortgage form you take the process past pre-qualification. You filed a credit card applicatoin through home financing Banker having removed your credit rating, and you will you have because of the lender all required paperwork to possess financial pre-approval questioned of the bank away from income, assets and you will work. Which have a great pre-acceptance to have credit, an underwriter possess analyzed the borrowed funds file and you will awarded a created vow so you can lend, subject to report about an assessment toward family at issue and other conditions mainly based after you look for your residence.

Out-of a genuine estate agent’s angle, pre-acceptance will provide you with a base through to other, less-wishing customers. Pre-recognized homebuyers is work faster after they see property they require as they have its capital better at hand. In fact, of several realtors will only work with pre-accepted homeowners as they understand its spending budget confidently. It also shows suppliers that buyers was a serious buyer.

What to anticipate

Pre-degree might be faster than simply pre-acceptance as the bank cannot make sure what you may have provided. To have a good pre-certification, lenders often typically ask for yours contact information, a quotation of the credit score, a general notion of family rates and you will what type of family you are searching for (priily domestic, etcetera.). Lenders should identify your debt-to-earnings ratio (the fresh portion of your terrible month-to-month income that would go to purchasing of your own overall debt) as well as your prospective mortgage-to-really worth proportion, or LTV (the newest part of the worth of the house you are looking to buy one to represents your property amount borrowed). Be also prepared to tell your bank about people down payment you’re gonna create. Borrowing from the bank may not be searched, thus don’t get worried about an excellent pre-certification inside your credit history.

To have a beneficial pre-acceptance, Reece City loans the lender have a tendency to see your credit score and have your to own initial economic records such as tax returns, shell out stubs, W-2s, lender comments, etcetera. It’s an out in-breadth studies of one’s money, very expect it when planning on taking a few days or maybe more. The additional big date will probably be worth they eventually given the clout pre-approvals has actually.