Regardless if you are considering cashing out your 401k otherwise providing good mortgage of it, think about this pointers to help you make an educated decision.

Shortly after several years of normal contributions, a 401k package via your manager can become one of your prominent economic assets. In many cases, your employer can get enables you to borrow secured on the income in the you to definitely plan, that is certainly a different sort of monetary benefit to you. As well as in most other times, you might want to cash-out your 401k and take a great 401k pecuniary hardship withdrawal. Here is particular guidance so you can learn this type of 401k financial tips, particular legislation and tax implications.

401k mortgage

If you’re considering financing out of your 401k bundle, glance at your own employer’s want to establish for people who can use from it. Listed below are some what things to recall.

- 401k mortgage limitations. For the majority of agreements, this new Internal revenue service states “the most your plan normally allow because the a loan is actually both the greater number of out-of $10,000 otherwise fifty% of the vested account balance, or $50,000, whatever are quicker.”

- 401k mortgage fees statutes. There are requirements to own payment out of an excellent 401k mortgage. Earliest, the cash needs to be paid off, usually more a beneficial four-12 months months. For individuals who end, try let go or if perhaps the new 401k plan are ended, the loan often generally speaking getting due in this 60 days. This might be a giant financial strain on you while doing so so you can setting right back pension preserving. Yet another downside is that if the borrowed funds is not repaid whenever owed, then the loan harmony will be handled once the a withdrawal and you can can be subject to taxation together with an excellent ten% penalty income tax when you are more youthful than just 59? yrs . old.

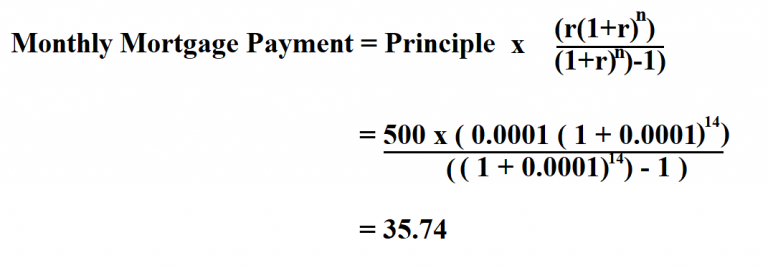

- 401k loan attention. You are going to need to pay the cash back with attract, that many cases are lower than appeal energized at a loan company otherwise credit cards. Luckily for us, the interest try paid to your 401k membership, to not your employer, so you is make payment on cash return to help you yourself. Paying the loan back comes best from the salary, as well. Very remember that this may decrease your get-domestic pay before the mortgage is paid back.

Cashing out your 401k

It can be tempting when planning on taking the major lump sum payment out of the 401k once you exit your work and set it towards the your hands rather than moving it more than to the a unique 401k or IRA. However it is important to understand the taxation outcomes if you decide to visit one route.

401k rollover

When you leave your job, you can take your 401k with you. For people who roll over your own 401k balance with the an IRA otherwise your brand-new employer’s senior years package, your money will continue to expand having later years. A direct rollover literally means might roll the cash from you to definitely account to a different, with no currency getting in direct your fingers through the transaction.

401k taxes

Unless you’re 59? otherwise older, you’ll are apt to have to expend income taxes toward finance taken along with good 10% punishment tax. That may make withdrawal very costly.

If you have kept your employer and are usually over-age 59?, you’ll not face the latest ten% federal tax punishment by firmly taking their 401k equilibrium while the a nonexempt shipments. You are going to need to pay taxes to your total matter taken until an element of the financing try Designated Roth Efforts. When you’re nevertheless employed, the plan may limit distributions of balance even when youre decades 59? otherwise earlier. Consider seeing your taxation mentor before you take a nonexempt delivery out of your 401k bundle.

Called for minimal withdrawals (RMDs), while it began with April following season you change 72 (70? if you were 70? just before ), was important for one equilibrium stored in the fresh new 401k bundle.

401k difficulty withdrawal

Some 401k arrangements get will let you withdraw funds from your own senior years when it comes to pecuniary hardship. This type of adversity shipments needs to be due to a good big and you will quick monetary you desire. And the total become withdrawn is restricted from what is necessary to match the you would like.

- Scientific expense for your requirements otherwise all your family members.

- Expenditures related to the purchase of an initial home, excluding mortgage repayments.

- University fees and you can associated educational charges and you can costs for nearest and dearest.

- Expenses regarding a stated emergency.

- Payments must avoid eviction off, or foreclosure toward, a principal residence.

- Burial otherwise funeral expenditures for a wife otherwise depending.

- Specific expenditures for the fix out of injury to their principal quarters.

Although not, your boss will get decide for everybody, specific or nothing ones should be entitled to hardship distributions regarding the 401k bundle. Together with, if you located a trouble detachment regarding 401k package, you may not have the ability to sign up for your bank account for half a year. And you can number withdrawn cannot be paid on plan. These types of distributions will normally be subject to each other income tax and you may an excellent ten% tax punishment (getting members around age 59?), very think about it because the a past resort to own a life threatening crisis.

Volatile factors in daily life for example leaving your job, having loans otherwise sense a sickness may cause you to get that loan, cash-out and take money from the 401k membership. However, think about it merely after you’ve worn out your hard earned money coupons membership. You happen to be best off in search of most other sourced elements of earnings or a special mortgage sort of. That way, you can help to keep retirement loans safe for its correct goal, advancing years.

All the details on this page is actually extracted from individuals supplies not from the State Farm (also State Ranch Mutual Auto insurance Providers and its particular subsidiaries and you will affiliates). Once we accept it as true become credible and you can specific, we do not warrant the precision otherwise accuracy of your information. Condition Farm is not responsible for, and does not recommend otherwise approve, often implicitly or clearly, the content of every third-cluster sites that would be hyperlinked out of this page. What is not meant to exchange manuals, guidelines or recommendations provided with a manufacturer or perhaps the guidance off a qualified elite group, or even affect publicity around one relevant insurance plan. This advice aren’t a complete selection of all losings handle measure. Condition Farm helps make no promises regarding comes from use of which suggestions.

Just before going more possessions out of a manager-sponsored retirement bundle to the an enthusiastic IRA, it’s important you to customers discover its choice and you can would the full assessment to the variations in the newest promises and you can protections given by each particular particular membership therefore the differences in liquidity/funds, sorts of expenditures, costs, and you will any potential charges.

State Ranch Life insurance policies Team (Perhaps not subscribed within the MA, Ny otherwise WI) State Farm Lifetime and you can Collision Assurance Team (Subscribed for the Nyc and you may WI) Bloomington, IL