Construction financing are going to be structured in some indicates, based if or not you also need to purchase house or already very own much. For people who already very own home and want to create with it, you can finance your home in lots of ways. Lazear payday loan online The bank is different, therefore it is always a good suggestion to go over the options having some organization to find the solution that works well effectively for you.

Capital As a result of a financial

Whenever exploring new house investment with a bank, begin by the one(s) that you currently have relationships. The greater a financial knows your financial record, a lot more likely he or she is to work with you. not, not all finance companies promote structure finance, so if yours doesn’t, you will have to check other available choices in the region.

Quite often, you’re going to have to generate a deposit regarding 20-30% of your full amount borrowed. Although not, for folks who very own this new house outright, you have the option to use it while the guarantee. That is good alternative if you find yourself seeking save your self dollars and you will would rather to not ever carry out a life threatening down-payment.

Money As a result of a creator

Particular builders has actually established matchmaking that have lenders otherwise have created the very own financing enterprises to make it easier for people to track down a housing loan. In many cases, these businesses promote aggressive costs and you will pricing, so even though you have the choice so you can safe a loan which have a lender, it’s smart to consult with your builder before you could next to see what they give you. A creator might also be in a position to bring several possibilities, while a bank will only offers one to highway.

One of the benefits out-of capital through a creator would be the fact you don’t need to become middleman between the financial and you can the fresh builder. As they has a preexisting relationships, they will share the important points of the house acquisition, appraisal, and final approvals. The fresh agents that give builder financing also provide accessibility software one banking companies or other business do not, so make sure you talk about all selection.

Ready your Earnings

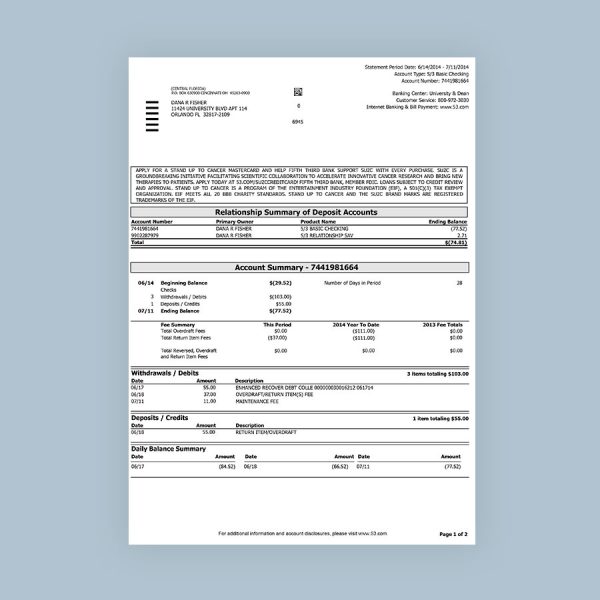

No matter what and this channel you are taking, any lender need to get a hold of track of debt background. It is possible to make the procedure go more smoothly by getting ready this new pursuing the records ahead:

- A job and you will earnings record

- New deed and you can name towards the property to prove control

- Tax returns

- W-dos models

- Bank statements

- Property assessment

Most loan providers look for at least 3 years of information, very start indeed there and become happy to increase the amount of while the requested.

See the Timing

Structure funds normally feature a time limit just before he is changed into a traditional permanent investment provider. This really is made to assist you enough time to build in the place of with a mortgage fee. You will need to understand the structure loan title (in the event it initiate just in case it closes) and therefore committed figure is actually sensible. Eg, should you get a financial structure mortgage to have half a year and you may the home actually done after those individuals 6 months, you’ll have to start making principal payments, even although you have not yet , moved within the. This will establish a cash flow problem for almost all home, so make sure you comprehend the ramifications of the credit agreement prior to signing.

For those who own homes and so are considering the fresh design, communicate with an Adair Belongings affiliate concerning available options to help you funds your property. I composed Alliance Financial Services only for providing investment to possess Adair House people. Alliance even offers the full room off financial characteristics, together with permanent capital, and in case you choose to refinance afterwards, you have a reliable lover. Contact us right now to discover more.