No information regarding account number otherwise playing cards is required to build repayments with your cellular telephone, so it never should be distributed to gaming sites. Cellular take a look at places normally take anywhere between about three and you may 5 days in order to process, make sure and clear. In some cases, merely area of the view get clear instantly, and also the rest clears the following working day.

According to the lender, fund deposited through mobile consider put is generally readily available as soon because the overnight. Financial institutions have money availability formula you to decide how long it takes to own a to clear. Certain banking institutions, for example, makes an element of the consider available immediately, along with the rest readily available the next working day. If you’re also concerned about protecting your financial suggestions on the web, you’re thinking if cellular consider put is safe so you can explore. The newest small answer is you to cellular look at deposit can be as secure as your other on the internet and cellular financial features.

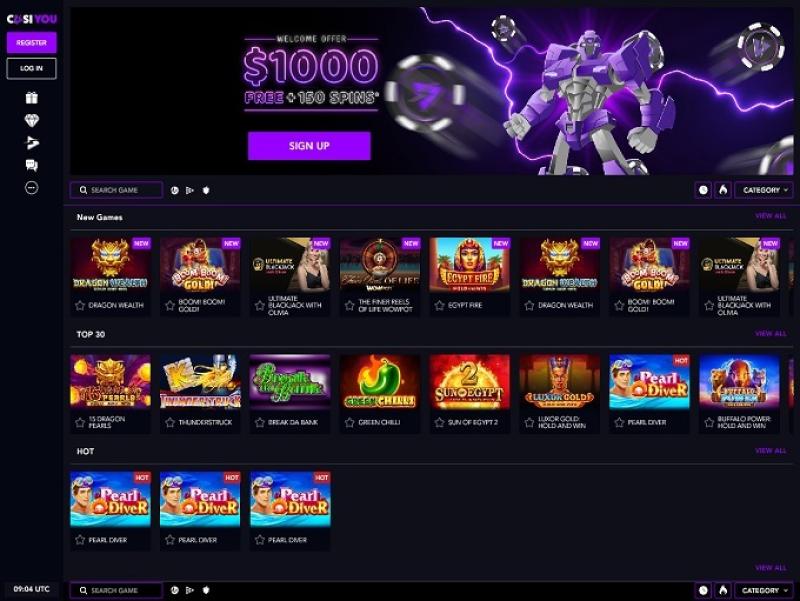

Casino aces and faces – The newest shell out by the cellular telephone casinos to avoid

Same as a regular view, your own lender can also be lay a hang on the funds transferred because of the mobile phone. A familiar reason for very-called defer method of getting fund is the fact that money was placed too late throughout the day. Immediately after a specific cutoff time for view deposits, the fresh depositor might have to wait a supplementary business day to possess the fresh view to clear and for the fund to become available. You could wonder who are able to gain access to the brand new delicate suggestions shown on the a check, however, view images aren’t stored in your cellular telephone. Rather than bringing a check on the lender, cellular view deposit allows you to snap photos of your front and you may right back from a, publish these to an app and you can put the brand new view digitally.

What is cellular view deposit and how can it work?

When you’re casino aces and faces requested to be Telmate Affirmed it means your own business demands verification of your own identity prior to welcome out of inmates’ phone calls. The purpose of confirmation is always to make sure inmates aren’t hooking up having incorrect someone externally. Gather phone calls allow you to instantaneously undertake and you will pay money for calls to your land line cellular telephone membership. Once entering the deposit suggestions you can transfer the newest deposit in order to SafeDeposits Scotland from the debit credit, cheque otherwise BACS. And you may affiliated banking companies, People FDIC and you will completely had subsidiaries from Financial from America Firm. Phone calls are limited to half-hour for every label, leaving out the fresh inmate’s lawyer.

Remark the features and you will Dangers of Standardized Alternatives pamphlet before you could start trading choices. Options investors can get lose the complete quantity of the investment otherwise much more in the a fairly limited time. Possible traders is to consult with the individual tax advisers regarding your taxation consequences centered on their points. You can view their eCheck Deposit activity for the past 120 weeks.

to possess Put money in order to a keen inmate’s individual account

The availability of the financing will be defer when the there’s a problem with the fresh put. You will get a primary email address notification verifying one we now have received your deposit and one whenever we’ve recognized they for processing. Processing Photographs.You approve us to techniques one Image which you send us otherwise transfer a photograph to an image Replacement for File. You authorize all of us and every other lender that a photograph is distributed so you can techniques the image otherwise IRD.

An electric cooperative must pay attention to the deposits on condition that the bylaws allow for assignment from margins so you can players or customers. Sure, your company utility may require in initial deposit to ensure coming percentage, as mentioned on the utility’s written put rules. Here are some our very own useful ‘Tips’ guides to own all you need to learn to help you navigate the working platform and step-by-step suggestions away from protecting a deposit on solution.

For individuals who refuge’t downloaded your financial institution’s mobile app, you’ll have to do so it before you create a cellular deposit. Your normally are able to find your own financial’s application for the Application Store (Fruit gadgets) and you can Bing Enjoy (Android devices) programs. You can use cellular deposit for the majority of paper inspections, along with individual monitors, organization inspections, and you may regulators-granted inspections.

Generate a consultation

When you phone call, be ready to deliver the appropriate account number, studio, inmate, and you may commission information. Making a trust Money and you will/or PIN Debit put, you happen to be required to deliver the facility’s “Site ID” (which, if needed, are available for the facility’s web page). Need a bank checking account regarding the U.S. to utilize Post Currency that have Zelle. Purchases generally take place in minutes if individual’s email address or You.S. cellular matter has already been enlisted having Zelle. Particular creditors usually ask you to make particular text for the the back of the new consider, or look at a box, authorizing they to own remote deposit just. Ties services and products given thanks to Friend Invest Ties LLC, representative FINRA/SIPC.

Simple tips to deposit a check on the web

ET, your look at will be canned another working day. Certain otherwise all the Eno features might not be offered to all of the Investment One to users, with regards to the type of accounts held. Such as, particular bank account commonly permitted text that have Eno, and Eno email address notifications, application announcements and you will virtual credit quantity away from Eno is almost certainly not readily available for specific credit cards. Mobile take a look at put are a fast, smoother treatment for deposit fund using your smart phone. So that as monetary technical and you will digital money government equipment always progress, the process is secure and easier than before. Second, endorse the fresh view you need to deposit—as if you manage if you were transferring it at your regional department.

The fresh Pursue checking customers delight in a great $3 hundred extra after you unlock an excellent Pursue Full Checking membership and then make head deposits totaling $500 or even more within ninety days out of discount registration. Get more of a personalized dating giving no everyday banking fees, concern solution from a dedicated party and you will unique advantages and you will pros. Apply at a good Pursue Personal Client Banker at the nearby Pursue part to know about eligibility conditions and all of offered pros. Cellular deposit allows you to rapidly, easily, and you can properly deposit a on the checking account instead of going in order to a part or Atm. To make sure the method happens effortlessly, stick to the right steps, such properly promoting the fresh consider and you may taking obvious photographs of they. You’ll be provided with the choice to select and this account will get the brand new deposit, just like your checking otherwise savings account.

You could inquire about most other put alternatives for the time being if you would like add the consider for you personally Asap. Cellular deposits are believed as the secure and safe as the any other bank-approved form of deposit a check. The new Chase Cellular software, for example, never ever locations passwords or image research in your device while using the Chase QuickDeposit℠.

MoneyGram is among the premier wire transfer companies worldwide. Consumers at the MoneyGram’s 284,100000 urban centers inside the all those nations is receive and send currency because of a person-to-person otherwise cash-to-dollars transaction. Which have faith and you will commissary fund, the one you love or friend will get money to look at the the business commissary where they’re able to purchase food, toiletries and you can dresses such as clothes and you will undies. Depositing money from the an excellent reception kiosk situated in one of the of numerous detention institution nationwide is a safe treatment for score money to your incarcerated loved one instantly. Particular organization want label confirmation very take your rider’s permit or any other sort of ID.

None Lender nor Merrill try a factory away from methods otherwise application. “Bring Equipment” form people device acceptable in order to us that give to your capture out of photos of Issues as well as for indication from the cleaning process. There’s no more fee for making use of Mobile Take a look at Put however, we recommend that you check with your company to see in the event the there are one wireless company charges. Conference arranging is provided by Engageware, whose confidentiality and you may shelter regulations or actions may differ from Countries.