Financial basic facts

Choosing just the right financial option make the difference between a short preapproval or an unsettling loan denial. Numerous authorities businesses give loan applications one to serve individuals that have low credit ratings, army borrowers or lowest-earnings consumers searching for homes into the outlying parts of the country. Traditional loans are definitely the preferred mortgage style of, nevertheless they are available to the strictest qualifying standards.

Loan providers realize rules set because of the Fannie mae and you may Freddie Mac so you can accept antique fund. The fresh new Federal national mortgage association HomeReady and you can Freddie Mac computer House Possible financing are capable of earliest-big date homebuyers, and you may borrowers will get be considered having off money only step 3% and you can credit scores as low as 620. Earnings restrictions have a tendency to incorporate.

Backed by the new Government Casing Administration, FHA fund simply need an excellent step three.5% advance payment with fico scores as little as 580, and also makes it possible for results only five-hundred that have good 10% down-payment. Meanwhile, FHA home loan insurance fees are more costly than just old-fashioned personal financial insurance policies (PMI) and cannot be avoided regardless of your own deposit count. Still, there are not any earnings limitations on FHA finance.

Most recent and resigned military provider players and you will eligible thriving spouses may be eligible for zero-down-fee loans secured by You.S. Institution out of Pros Activities (VA). Va financing assistance do not require financial insurance rates otherwise at least credit score, while most lenders lay the minimum credit history within 620.

The You.S. Service regarding Agriculture (USDA) backs finance that do not require down payments to have users trying to get into the rural communities. Income limits incorporate, plus the home have to be located in a beneficial USDA-appointed outlying urban area.

Home loan preapproval information

Once you have over new legwork to really get your finances able to possess homeownership, it is time to begin the borrowed funds preapproval process. Extremely manufacturers won’t also accept an offer in place of an excellent preapproval letter, very you should never forget such procedures or if you might end up with a string of refused also provides.

seven. Get documentation able

Some lenders promote electronic loan requests, your own preapproval is because strong given that recommendations your offer. To obtain the really perfect preapproval, enjoys these records convenient:

- Current month’s property value shell out stubs

- Last 24 months away from W-2s

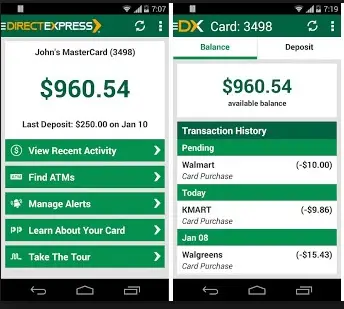

- A couple months of the latest financial comments

8. Look for a lending company

LendingTree studies keeps found that consumers which go shopping for a home loan will save over $63,000 typically across the lifetime of the financing. Get in touch with lenders, mortgage financial institutions plus neighborhood financial or borrowing union in order to see what they give you. Several additional info before you make up to you:

Costs alter every day, very done all of your current loan applications for a passing fancy time. In that way, you make an apples-to-apples analysis if you find yourself examining the loan rates.

Very lenders wouldn’t allow you to rating a home loan price lock until you have located a house, and others promote lock-and-shop apps that allow an excellent lock-during the while you’re family hunting.

Never assume all loan providers is actually acknowledged to give deposit assistance. You might have to shop with many extra loan providers if the you’re making an application for a particular DPA program towards you.

9. Ensure you get your preapproval page

After you’ve picked a lender, it is the right time to get the preapproval page. Brand new page must provide facts about the sort of loan you will be qualified for, such as the loan amount, interest and you can limitation PITI (dominant, interest, taxation and you will insurance rates) commission.

Remember: If you don’t give the lending company beforehand exacltly what the payment budget are, the fresh new preapproval page commonly mirror maximum your qualify for depending on your loan application. Inquire the financial institution to adjust the total amount payday loans Glenwood no credit check online off in case the max does not fit with the costs.