Sometimes brand new unanticipated happens. If you’re wanting instantaneous financial support, of a lot people’s basic thoughts are of employing its 401Ks so you can borrow currency. That cash simply sitting indeed there, proper? Positively it helps. Wrong. Although the effect so you’re able to use from your own 401K is practical, it does incorporate an array of bad consequences. Such cons usually somewhat provide more benefits than the pros whenever borrowing from the bank up against your own 401k. Instead, benefit from the guarantee you currently have and employ you superb or deluxe watch to get an accessories-supported loan out-of Diamond Banc.

Due to the fact 2008 houses crisis, a growing number of Us citizens was embracing the 401Ks because the that loan source. Family equity fund are no extended a choice for we and private loans are difficult if not impossible to rating. It making we who are in need of currency getting an emergency that have few options. But not, using your 401k so you’re able to borrow money are surely eliminated.

step 1. It will set your own next into your retirement wants

. An estimated twenty two% out of Americans only have $5,000 protected for their senior years. Individuals are currently significantly less than-saving getting advancing years. Borrowing facing their 401K only ingredients this issue. An excellent 401K old age funds lets the eye from your discounts to help you material over the years. In the an entry-level, this is exactly largely the point of a beneficial 401k. By taking the bucks away for a financial loan, which effortlessly prevents your own compound attention regarding accruing.

2. Making use of your 401K to borrow money can lead to your bank account in order to remove worthy of

Because you pay-off the mortgage you’ll end up re also-purchasing the offers you prior to now sold, usually at a higher rate. Which means you clean out most of brand new guarantee you may have gathered in your membership.

step 3. Look at the charges that accompany borrowing from your own 401k

Even if you was just borrowing away from oneself you will find costs associated with the obtaining financing, always a handling percentage one to visits the brand new administrator.

4. With your 401k to help you borrow cash can mean you will have faster offers ultimately

According to your own 401K bundle, you could treat the capability to subscribe this new fund while you are you may have an excellent financing up against they. Certain fund usually takes many years to expend right back, for example many years of no benefits from you or even the match sum from your own manager. Because most readily useful behavior having advancing years levels is normally to store as much as you can as early as possible, given the role of compounding attract, this will enjoys an effective snowball effect on your current offers. Efficiently lowering your offers down exponentially after you get to the many years of old-age.

5. Credit from the 401k often means down wages if you want money most

Really 401K financing installment arrangements want one to repayments for the financing feel deducted immediately out of your income, so that your capture-household pay will drop off. In addition to the payment actually income tax deferred, and that means you is taxed with it. It indicates you could potentially owe more than requested by the point taxation been due.

6. Taxes Taxes Taxes.

You’ll end up taxed for a passing fancy currency double. no checking account pay day loans You are repaying the borrowed funds which have currency that was taxed and if you withdraw from the 401K via your old age it is possible to feel taxed involved again.

eight. Borrowing from the bank from your own 401K often means low levels of safeguards

For people who quit otherwise is fired away from you employment, you need to pay off the mortgage within 60 so you can 90 weeks, based on your own bundle. While not able to afford the mortgage back into the payment several months, then the Internal revenue service takes into account the loan a shipping. Extent you owe is now confronted with income tax, including a great ten% penalty if you’re 59.5 years of age or more youthful.

Rating a jewellery-supported financing unlike credit from your 401K.

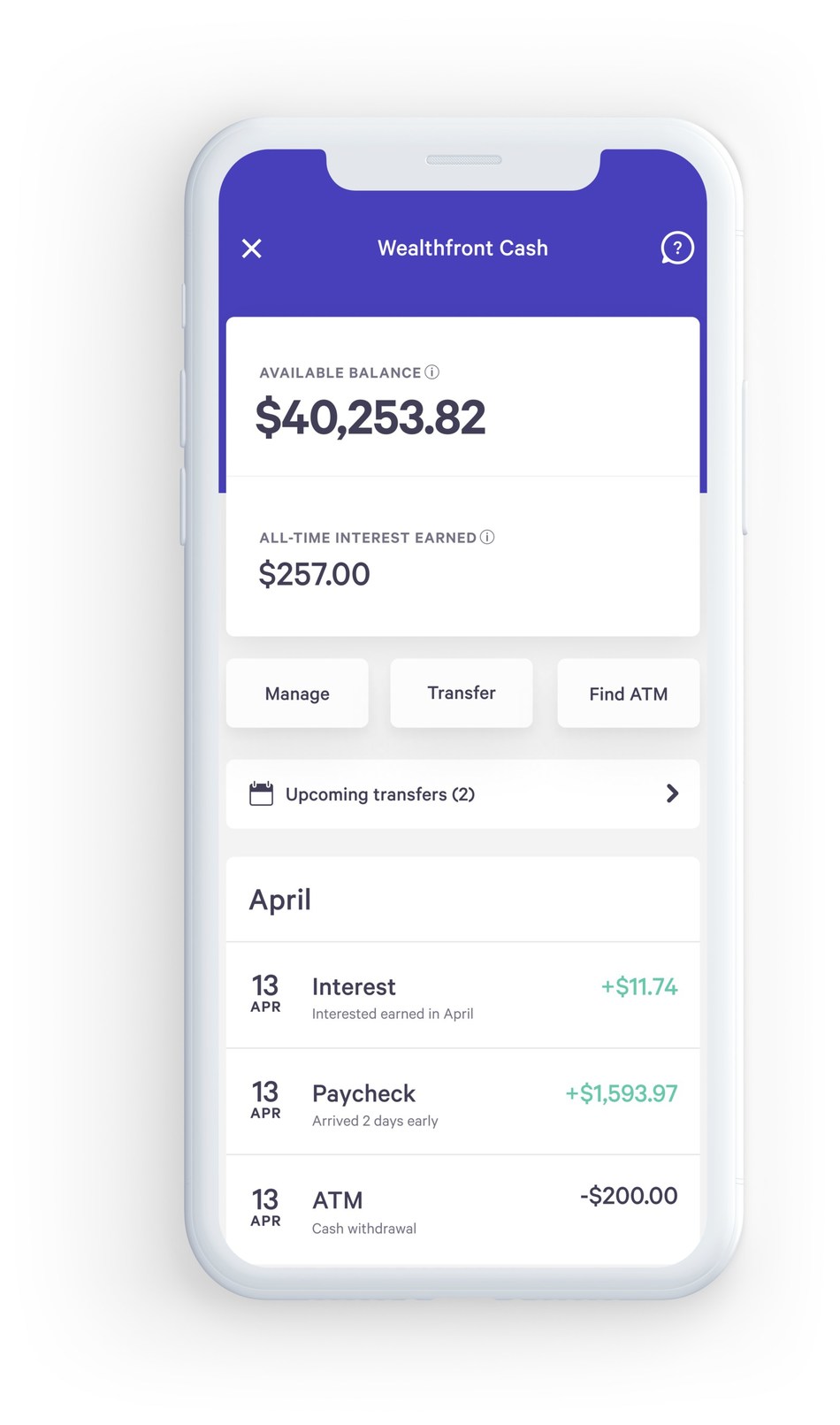

Cannot slide sufferer to your pitfall out of borrowing from your own 401K when there will be most useful solutions. Using your precious jewelry as security so you’re able to borrow funds is a superb way to keep your 401K intact, borrow funds in place of adversely affecting your credit rating, and also currency quickly.

Diamond Banc focuses primarily on delivering funds to individuals with fine expensive jewelry and you may involvement groups, high-avoid luxury watches and you will jewelry out-of greatest music artists for example Cartier, Bulgari, Tiffany & Co. and much more. These things are utilized because equity to help you keep the mortgage. The borrowed funds count depends upon the fresh new water general market price of item. Just like the mortgage is within fees, the object is actually stored in all of our safer container. Once you have paid down the borrowed funds, we are going to get back the thing to you personally. For those who default on loan, we hold the item and sell it to recuperate the quantity your debt.

Diamond Banc’s book mortgage procedure

Because amount borrowed will depend on new h2o worth of the object being pledged, we really do not work on any borrowing from the bank monitors, employment verification otherwise require an installment be certain that. I and dont statement the borrowed funds so you’re able to a card agency; which does not affect your credit score, even though you standard towards mortgage.

The borrowed funds process with Diamond Banc is quick and easy. We can often have fund on your own account in only a small amount because the two days. Only fill in a zero exposure, no duty mortgage quote function towards the site. Within 24 hours away from acquiring their submission we’ll send you all of our initially offer. As the initial provide is decideded upon, we will deliver a shipments term and you will advice, you can also take it with the place nearby you. Whenever we found your own plan we will make certain their items. Once you deal with our very own final offer and you may conditions, we will cord transfer financing for your requirements or post you an effective view immediately.

Visit the Diamond Banc site to learn more and submit our internet-based forms. Otherwise, head to a locations here.