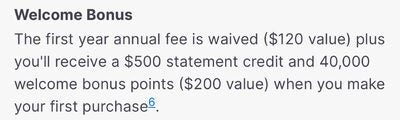

Record Debt

Of many people have used the AAMC’s MedLoans Coordinator and you may Calculator https://cashadvancecompass.com/personal-loans-ms/philadelphia/ so you’re able to organize and you can track the funds over the years. Profiles can also be upload the government loan suggestions, work with custom installment scenarios, and you will cut loan repayment alternatives for later on reference. In the less than clips, Feinberg’s Cynthia Gonzalez goes from the tool detailed.

Payment Solutions

Once your federal college loans enter repayment condition, you’ll prefer among of numerous cost solutions. Brand new less than video clips outlines this type of selection to discover the finest plan to help you fulfill your debt management requirements. The fresh AAMC likewise has summarized installment agreements having government pupils finance.

Financing Forgiveness Applications

From the below films, you will learn on the certain loan forgiveness, grants and you can financing installment direction applications, including the National Wellness Service Corps, Indian Fitness Provider, Public service Mortgage Forgiveness, the fresh military and other federal and state programs. More in depth information regarding this type of mortgage forgiveness apps can be obtained because of this new AAMC.

Way more AAMC Information

AAMC’s Basic (Economic Pointers, Information, Characteristics, and you can Equipment) will bring 100 % free tips to greatly help medical college students create smart economic conclusion off pre-matriculation through financing fees. Head to the website for much more info.

Feinberg’s Financial obligation Management Seminars

Are professional-effective on cash may help prevent stresses about money. Our very own financial obligation government counseling program, Lives $upport, was designed to remind pupils to ascertain a good economic habits instance once the cost management and you may examining borrowing frequently. Really lessons were a dynamic studying element of assist students acquire might enjoy needed seriously to build these activities. Talk about the list below out of necessary and optional lessons considering.

BYOB: Strengthening Your own Finances (M1-Before Matriculation)

This option-on-you to definitely session will become necessary for everybody entering youngsters receiving financial aid. College students are asked becoming wishing along with their help notification and you will a finished AAMC interactive cost management worksheet. Resources and you may costs are examined to determine if the loan funds is also feel came back.

Credit 101-Part step one (M1 Winter months)

So it example teaches pupils the basics on the borrowing from the bank. The purpose of the brand new class is always to assist people learn to create educated behavior from the borrowing from the bank. With this tutorial college students remove its credit file to own remark.

Borrowing 101-Area dos (M2 Fall)

The basics out of Borrowing 101 could well be examined. An easy way to protect borrowing from the bank will additionally be secured. The session often stop which have people pulling the credit report having comment. The target is to encourage children and then make that it to the good economic routine.

Which example facilitate pupils funds and you will arrange for new after that will set you back regarding what they can expect in the M4 seasons because they ready yourself of abode app process.

Personal Money Tips (M4 Spring season)

So it class is actually shown inside the M4 Capstone which is expected for everyone M4 students. In the session, youngsters might be explore interactive devices to help with cost management, W-cuatro income tax variations and you will borrowing from the bank.

M4 Requisite Education loan Get off Meetings (Three-Step Procedure)

Settling financing can be stressful for an individual who’s not familiar that have mortgage fees choices. To battle this problem, every students whom lent federal student education loans are required to over an effective about three-step education loan exit process through the Existence $upport system.

- Step 1: Check out AAMC Student loans and you may Installment Strategies VideoStudents will learn the new words and start to become regularly the basics out-of loan payment. Which foundation is critical to prepare children on the required one on one education loan fulfilling. Students may take an active role by signing into and publishing mortgage background into AAMC Coordinator/Calculator. Which have a copy of the AAMC Loans Manager Publication is additionally of use.

- Step 2: One-on-You to Loan Cost Appointment Children must satisfy that on that that have Cynthia Gonzalez into the AWOME to go over the financing collection. Cynthia will give attempt cost dates centered on actual personal debt. The objective of the new class is actually for this new pupil to completely learn the payment options. This will make it students to build a technique and set requires. Appointment solutions was printed in the future.

- Step 3: On the web Guidance From inside the mid april, college students are certain to get a message from the Northwestern School Work environment out-of Scholar Financing that have an invite and you may tips away from on the web guidance. It criteria would be over of the a selected go out, usually in early May. From inside the on line counseling, college students are required to choose an installment package. The master plan picked might be altered. The mark is the fact students could well be ready to get this selection immediately following completing the original a couple measures. Questions otherwise issues about this needs to be discussed at one-on-you to conference.

Don’t want to hold off to hear what’s protected in the you to-on-one loan cost fulfilling? Cynthia Gonzalez will bring an over-all article on all the information inside clips.

A mortgage for Graduating Medical Pupils and you can Owners (M4-Winter)

New AAMC provides a reported an informative video clips out of to order a property. Features are: choosing a good time to invest in and how far you could potentially afford, leasing rather than purchasing and budgeting getting a property.

Financial Think 101 (M4-Winter)

A guest speaker from MEDIQUS Advantage Advisers Inc. will share details about very first economic think enjoy. Features is: building an economic package, currency management and senior years considered.