If you find yourself contemplating bringing an interest rate, its vital to become familiar with various charges in it, including people you’ll shell out on closure.

Settlement costs become of numerous costs like the appraisal and you will name insurance, yet a serious element of this is the mortgage origination payment.

This might seem like a separate piece of monetary jargon. not, it is important to understand how which commission really works since it impacts the expense of signing their home loan.

Simply put, the new origination payment try charged by the mortgage brokers to cover will set you back out-of handling a software.

Speaking of preferred around the mortgages, and also other variety of loans instance personal loans and you will loans. Loan providers tend to be so it fee to recuperate the expenses they bear that have reviewing loan requests, examining an excellent borrower’s borrowing, guaranteeing its economic recommendations, and you will planning the loan data.

Simply how much try origination costs?

Normally, home loan origination charges safety a portion of one’s overall amount borrowed. The commission, although not, may differ of the financial additionally the type of financing. In most cases this new origination payment means 0.5% to one% of one’s loan amount. So if you obtain $2 hundred,000, you can easily spend up to $2,000.

Certain loan providers provide $0 mortgage origination, which means that they waive the common charge for operating that loan. Inturn, the brand new debtor will pay a somewhat large home loan rates.

In order you examine mortgage has the benefit of, pay attention to the origination fee along with other can cost you for example the speed.

After you sign up for home financing, the lending company will provide you with a loan Estimate. So it document brings an overview of the fresh new words and will set you back related to the mortgage. As you remark your guess, lookup according to the Mortgage Will cost you section to acquire facts about the mortgage origination fee.

Keep in mind that loan providers keeps her technique for structuring fees. But when you’re the malfunction can vary, prominent areas of the latest origination payment you will become:

- Loan Running: It talks about the management tasks involved with examining and operating your application for the loan. It could is opportunities instance get together and guaranteeing your information and you may ordering credit history.

- Underwriting: That it percentage covers the cost of assessing their creditworthiness, taking a look at debt data files (like earnings confirmation and you may tax returns), and you will determining this new regards to the loan.

- File Preparing: That it payment discusses preparing and you can providers of the many requisite loan documents, like the loan contract, financial note, or other court documentation necessary for closing.

When could you spend origination fees?

Closure is when you perform the house pick and you may signal all the financial files. Nowadays you might be necessary to afford the origination commission with each other together with other settlement costs (by way of either a certified glance at, cashier’s take a look at, or cable import).

If you learn it challenging to defense these types of costs, specific advance payment guidelines applications may offer financial help. However, if you’re around commonly certain software seriously interested in origination charges, you need offer financing to spend your own settlement costs, including brand new origination percentage.

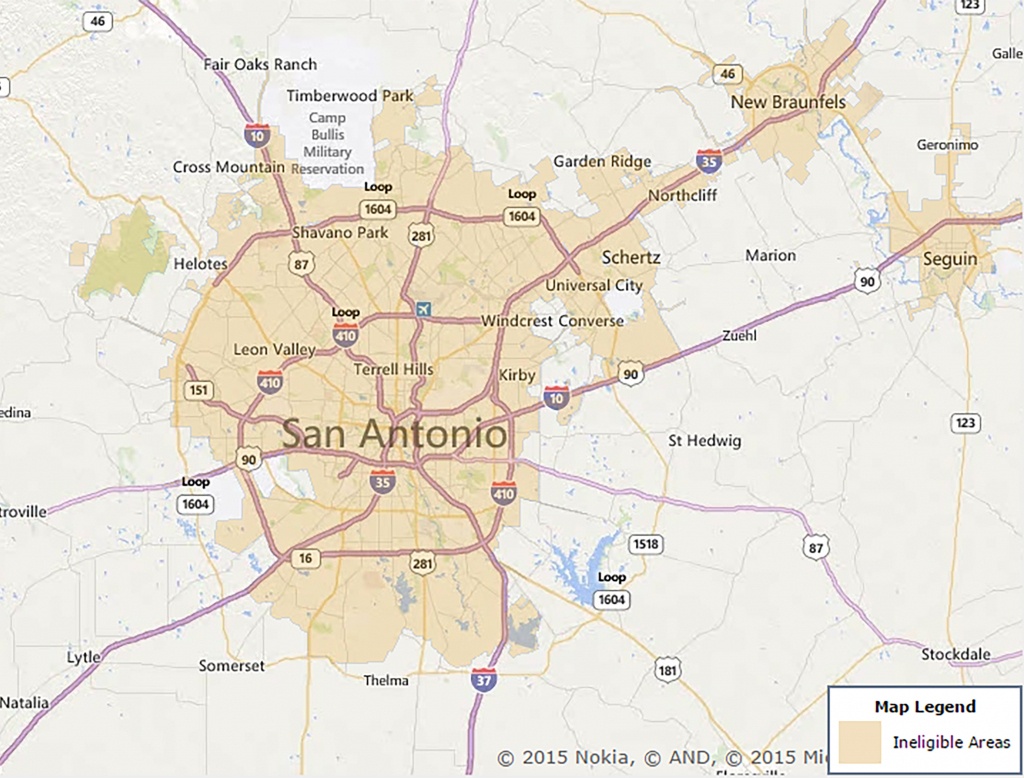

Such apps will vary from the place and have now specific standards and you will limitations. To know about readily available software near you, get in touch with your mortgage lender, local construction firms, non-funds groups, or bodies resources.

- Money Qualifications: Some homebuyer grant apps focus on someone and you may parents having lower income. These software might have particular income limitations otherwise guidelines that individuals need see so you can qualify. Income limitations may differ depending on the system therefore the town.

- Property Control: Normally, has offer assistance to earliest-day homebuyers and people to find a first quarters. These include unavailable having capital functions otherwise next residential property.

First, research rates and you will compare loan has the benefit of off various other loan providers. Essentially, you need to get prices regarding about about three lenders (credit unions, finance companies, online personal loan companies Lawrence PA lenders, financial organizations). By doing this, you will find the essential competitive terminology and you will probably shell out a beneficial straight down origination payment.

Together with, don’t hesitate to negotiate which have lenders. You could influence numerous financing offers to see if these are typically ready to minimize otherwise waive which fee.

Lastly, imagine some other financing brands. Government-backed finance eg FHA or Virtual assistant fund usually have significantly more favorable payment formations as compared to antique money.

The bottom line

When you’re origination charge may appear particularly a needless added expense when taking a home loan, it let coverage the expenses lenders happen in loan application process.

It percentage design may differ off bank to financial, it is therefore important to end up being hands-on. Rating numerous estimates away from additional loan providers, make inquiries, contrast costs, just in case you’ll be able to, discuss the fresh origination commission.

When you’re ready to begin and you will potentially save a life threatening amount of money by eliminating their initial can cost you, contact a home loan elite group now.