Buying your very first money spent means a strategic method. Mention such important procedures to be certain a profitable and you can informed money.

step 1. Mention Money spent Fund

Knowing the individuals mortgage options, such old-fashioned loans and you will jumbo financing, is vital to own creating the capital for the certain need out of forget the. Traditional finance, usually fitted to attributes that have cheap situations, give standardized conditions, making them accessible for some investors. Although not, they want that lay anywhere between 15%-25% off. At the same time, jumbo fund end up being related having higher-really worth properties, flexible huge financing demands. Evaluating such loan possibilities allows dealers to maximise their financial support structure, leverage beneficial rates and you will fall into line its economic means toward unique qualities of its chose money spent.

dos. Sign up for Home loan Preapproval

Before beginning your home search, you may want so you’re able to safer mortgage preapproval, that action not merely clarifies your sensible casing assortment but as well as establishes your besides prequalification because of the associated with a comprehensive opinion. A proven Recognition Letter (VAL), one step beyond prequalification, involves an extensive analysis, as well as an arduous borrowing from the bank eliminate and article on proof of money and you may property. It includes a very perfect image of your own eligibility. Having good VAL just allows one make told choices in addition to indicators to help you vendors that you’re a significant and you may legitimate consumer. This could enhance your updates in the a competitive market.

step three. Find the right Investment property

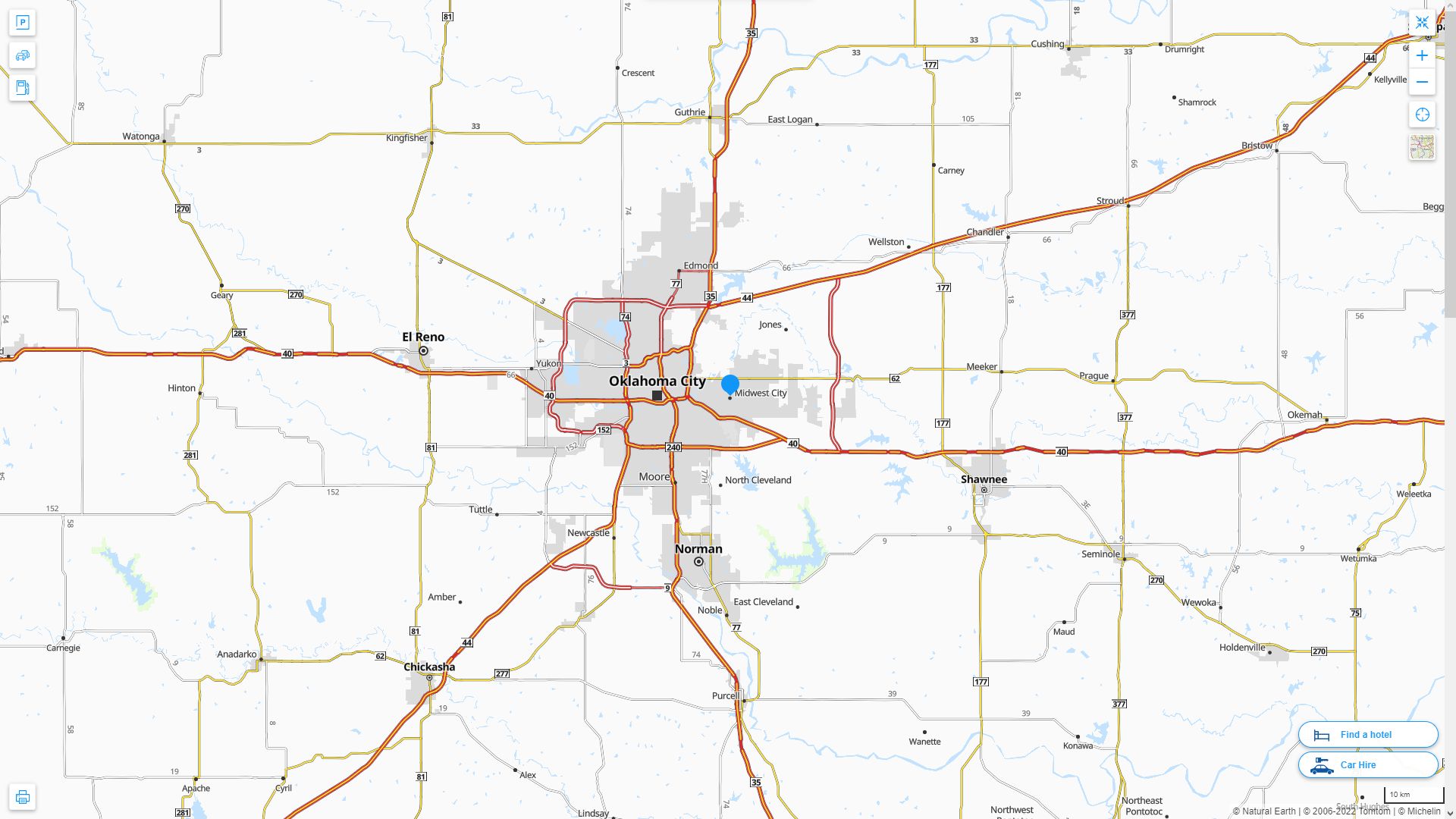

Selecting the most appropriate property is vital. Make sure to cautiously assess and discover your goals, once the some other services is align with different expectations. When you buy any kind of household, place is definitely among defining facts of the get. In cases like this, location usually influence the fresh new demand and success of one’s funding. A commercial assets inside the a primary place can also be attention companies, if you are a property during the a popular area does draw renters. If you are being unsure of from the deciding on the finest venue, choosing the expertise out of a realtor can be beneficial. The expertise in regional markets can provide insightful advice on highest-consult urban centers, improving your chances of and work out a successful and you will strategic funding.

Contrasting your own Profits on return (ROI) will bring a very clear and you will informative testing off a possible property’s profits. Regardless of an enthusiastic investor’s experience peak, Value for your dollar functions as an invaluable metric loans with no credit or id required to own researching various other capital potential and you may and work out advised conclusion. The basic Bang for your buck algorithm is straightforward,

Situations instance resolve and you can maintenance will cost you, 1st borrowing quantity and mortgage words can be influence brand new computation, centering on the necessity for an extensive research. From the deteriorating preferred conditions and you can bookkeeping for those variables inside the the calculations, your be certain that a more appropriate knowledge of the investment’s economic stability, fundamentally powering you into the secure and you will lucrative a residential property potential.

5. Find professional help

Take part assistance from real estate professionals, eg a qualified inspector and you can a bona-fide property attorneys, to make certain a thorough comprehension of new property’s reputation and courtroom facets. An assessment is inform you prospective problems that may possibly not be instantly noticeable, when you’re legal advice helps navigate advanced deals and you will guidelines. Leverage the help of these benefits contributes a supplementary coating of defense and you will trustworthiness, defending disregard the and you will providing skills you to sign up to a highly-told decision.

The conclusion

Getting into owning a home even offers profitable choice, but wise ount. Measure the prospective experts, instance passive money and you may security buildup, and you can look at the associated threats. Because you weighing this type of factors, it is the right time to operate. Start the borrowed funds recognition techniques right now to grab the latest possibilities inside the resource characteristics, making sure a charity getting advised decisions and you may successful opportunities.

- Sector chance: If you are navigating the real estate market, dealers don’t have any control of the marketplace, posing a prospective exposure foundation. A changing markets is going to be an even bigger chance to people thinking of using into the lasting because there are unforeseen alterations in economic conditions, interest levels as well as demographic shifts. While the a trader, definitely carefully assess and you can adapt your techniques to mitigate hazards in the market volatility.

If to shop for a rental assets isn’t the correct complement, talk about different types of a house assets such as Investment Trusts (REITs) otherwise crowdfunding programs. REITs offer varied portfolios in the place of lead possession, if you find yourself crowdfunding need straight down capital much less hand-into the administration. These options give liberty for these maybe not able to possess possessions ownership, and talking to a professional could possibly offer custom information for your monetary wants.