What’s Freddie Mac computer-Government Home loan Financial Corp. (FHLMC)?

The fresh new Federal Home loan Mortgage Corp. (FHLMC) are a stockholder-owned, government-paid enterprise (GSE) chartered because of the Congress for the 1970 to save currency moving in order to financial loan providers, which helps homeownership and you can rental property having center-income People in america. The latest FHLMC, familiarly labeled as Freddie Mac, orders, guarantees, and you may securitizes home loans which is a pillar of your additional home loan business.

Key Takeaways

- Freddie Mac computer is the technically recognized nickname towards Government Family Financing Home loan Corp. (FHLMC).

- Freddie Mac is actually a shareholder-had, government-backed business (GSE) chartered by Congress in 1970 in support of homeownership for middle-earnings Us citizens.

- New part out-of Freddie Mac is to find lots off fund away from mortgage lenders, then combine her or him and sell her or him because home loan-recognized bonds.

- Federal national mortgage association and Freddie Mac computer is actually one another publicly traded GSEs. The main difference in him or her is that Federal national mortgage association purchases mortgage money away from significant merchandising or commercial finance companies, when you are Freddie Mac get its funds regarding smaller banks.

- Particular provides contended one to unchecked gains to own Fannie mae and you may Freddie Mac computer try an effective pri that became the good Market meltdown.

History of Freddie Mac

Freddie Mac is made whenever Congress passed new Emergency Home Fund Operate in 1970. A completely owned part of your own Federal Mortgage Bank system (FHLBS), they depicted a make an effort to get rid of interest rate risk to possess coupons and you can loans contacts and you can faster banks. In the 1989, according to the Financial institutions Change, Recuperation, and you may Administration Work (FIRREA), Freddie Mac undergone good reorganization. They turned into a publicly had company, having offers which will exchange for the Nyc Stock-exchange.

Inside 2008, into the overall economy sparked of the subprime financial meltdown, the brand new U.S. government-especially, the fresh new Government Property Finance Agency-grabbed more Freddie Mac computer. Although it’s slowly transitioning to your liberty, it stays under federal conservatorship.

What does Freddie Mac computer Perform?

Freddie Mac computer was created to enhance the circulate from borrowing from the bank in order to different parts of this new benefit. And additionally a comparable GSE, Fannie mae, it is a switch pro from the additional financial sector.

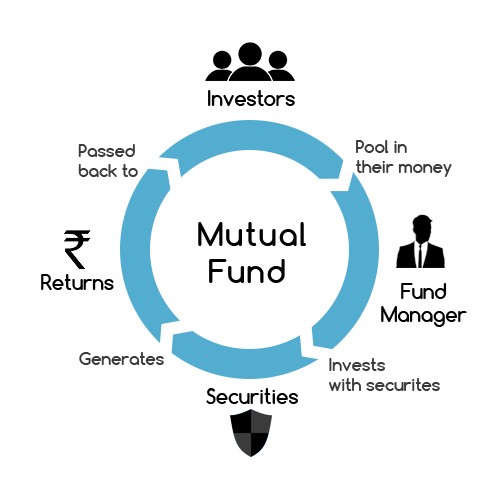

Freddie Mac will not originate otherwise solution home loans in itself. Instead, they purchases lenders off banking institutions or other industrial mortgage brokers (providing these institutions loans useful link that they’ll following use to loans way more finance and you may mortgage loans). This type of funds need see specific requirements you to Freddie Mac set.

Just after to find a great deal of such mortgage loans, Freddie Mac either holds him or her in own profile or combines and you can sells him or her since the home loan-backed securities (MBS) so you can dealers who will be looking to a steady money weight. In any event, they “insures” this type of mortgages-which is, it pledges the brand new fast percentage regarding dominant and you will notice into the financing. Thus, ties awarded by Freddie Mac computer become most liquids and you may hold a credit score alongside compared to U.S. Treasuries.

The new part of all the You.S. home loan originations (that is, the latest financing) securitized and you may secured by the Freddie Mac computer and its own sibling organization, Fannie mae, by middle-2020.

Criticism of Freddie Mac

Freddie Mac computer has arrived under issue just like the their ties towards U.S. authorities let it borrow money from the interest levels lower than those people offered to other creditors. With this specific resource advantage, it facts huge amounts out-of financial obligation (recognized available while the service obligations or agencies), and as a result sales and keeps a massive profile out-of mortgage loans also known as their chose profile.

Many people accept that how big is the fresh new employed profile shared toward complexities off dealing with mortgage exposure poses a great deal from systematic risk towards the You.S. discount. Experts possess argued that the unchecked development of Freddie Mac computer and Fannie mae contributed to the credit crisis regarding 2008 one to plunged the latest You.S. towards the Great Market meltdown. (In response, advocates of the businesses argue that, whenever you are Freddie and Fannie generated bad team behavior and you may stored insufficient financial support in casing bubble, its portfolios made-up simply a tiny fraction away from full subprime money.)

Federal national mortgage association and Freddie Mac’s solitary-members of the family foreclosures moratorium, applied because of the 2020 economic crisis, concluded into . Although not, home possessed evictions is actually halted up until s remain. Homeowners which have mortgages normally enter and stop the payments to own right up so you can annually; people who had been signed up at the time of , will get be eligible for doing eighteen months. Most other borrowers may be eligible for financing amendment.

Freddie Mac versus. Federal national mortgage association

Federal national mortgage association (Federal national mortgage association or FNMA) is made in 1938 as part of an amendment toward Federal Housing Operate. It absolutely was sensed a government company, and its particular character were to try to be a vacation mortgage industry that could buy, keep, otherwise sell loans which were covered by Federal Casing Management. Federal national mortgage association prevented getting a federal government department and you can became a beneficial private-social agency under the Charter Operate from 1954.

Fannie mae and Freddie Mac are comparable. Both are publicly replaced companies that were chartered to serve a good societal mission. Area of the difference in both relates to the main cause of one’s mortgage loans they pick. Federal national mortgage association shopping mortgages away from major merchandising or commercial finance companies, whenever you are Freddie Mac computer obtains their loans out of faster banking institutions, also referred to as thrift banks or deals and you may loan associations, which can be concerned about taking financial functions to communities.