Variety of Home loan Costs

Homebuyers trying to find an easily affordable mortgage can evaluate different interest rates to see a knowledgeable fit for the problem. The 2 variety of home loan rates are repaired-price mortgage loans and changeable-price mortgage loans. (ARMs)

Varying Speed Mortgage vs. Repaired

Fixed-Speed Home loan: A home loan with an interest price that stays a comparable about life of the mortgage. This means that the monthly installment count will stay an identical. Individuals can be estimate the whole visitors settlement costs and you may package ahead of time.

Adjustable-Rates Mortgage: A home loan is interested price that changes along side life of the borrowed funds. The speed can differ from month to month predicated on sector indexes. How many times the interest rate change depends on your loan arrangement.

The brand new monthly premiums try truly proportional toward style of appeal price you select. You could potentially calculate the very last charges for the house or property you prefer to order based on debt position and you may certain loan terms.

15-, 20- and you will 30-Season Mortgage loans

A property client can https://paydayloancolorado.net/perry-park/ decide the period to repay the mortgage. It can be an effective fifteen-seasons repaired rates mortgage otherwise a 30-seasons changeable price home loan.

A short-identity financing, such as for instance an excellent 15-season otherwise 20-year mortgage, mode large monthly payments. However, you’ll spend substantially less than the eye on a thirty-seasons financing.

You might decide which particular financial several months is most beneficial centered on your financial predicament, particularly latest money and assets.

What Has an effect on Mortgage Costs?

When borrowing from the bank currency for purchasing a home, the loan interest rate will likely be a predecessor so you can how much the house costs. The factors that affect financial pricing also provide a task so you can play here.

- Rising cost of living

- Federal Set aside Financial Rules

- Monetary Growth rate

- Housing market Conditions

Mortgage Costs and you may Real estate market

If for example the financial costs is actually large, you will have limited home buyers deciding to score a mortgage, and property will spend more weeks with the sector, so it is a consumer’s industry.

In case your financial cost is low, after that there are far more consumers putting in a bid to possess functions. Domestic conversion would be quicker, and you can property into the desirable cities might victory the bidding combat amidst numerous also offers, making it a trending seller’s business.

Form of Mortgage loans

step 1. Government-Backed Mortgage loans: New U.S encourages owning a home across the The usa that have FHA, Virtual assistant and USDA money. The government is not a lender right here, but have teams like the FHA (Government Construction Connection), USDA (All of us Institution regarding Farming), together with Va (Experts Administration Institution). to really get your home loan processed through available loan providers.

step 3. Jumbo Funds: Fund one to slide means above the standard borrowing from the bank constraints. Most appropriate getting borrowers thinking of buying an expensive possessions

4. Fixed-Rates Mortgage loans: An interest rate where the rate of interest is restricted and you may doesn’t change-over the new lifetime of the borrowed funds.The payment does not changes till the mortgage is signed.

5. Adjustable-Rates Mortgage loans: An interest rate the spot where the interest change according to the volume decideded upon to your bank. The new payment will vary across the lifetime of the loan.

- Balloon Mortgage loans

- Piggyback Funds

- Difficult Money Finance

- Framework Financing

Getting a mortgage?

Methodically package the property buy. From building your credit rating in order to hunting for our home your require, what you takes time. A step-by-action way to score home financing usually works out this:

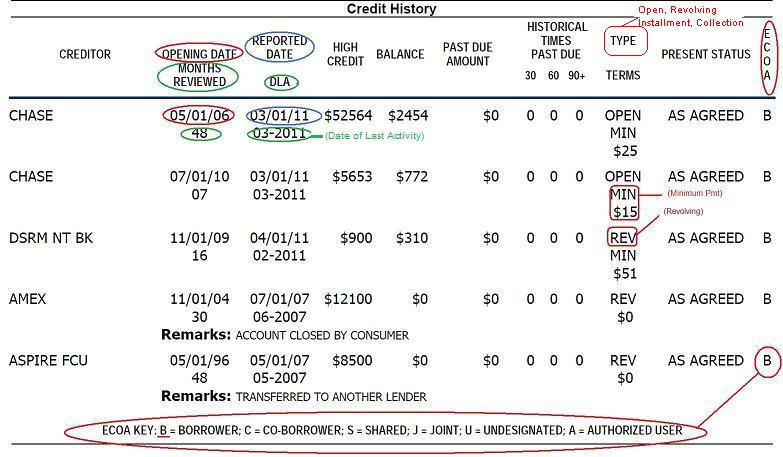

- Raise Credit rating: To eliminate purchasing large desire, you need to improve your credit rating. And also make timely repayments for your obligations can assist replace your score over the years. Despite a less than perfect credit get, you can buy home financing, nevertheless the interest rate is rather highest.