The new Agency having Training has actually kept ?27,295 given that salary at which you start repaying, despite showing this will increase that have inflation, definition it scoops in more lowest earners to settle.

I asked my pals who along with went to college or university regarding their debt: this new quantity cover anything from ?53,000 to help you ?75,000. For most of your careers, it count continues to eat highest pieces into the all of our paycheck each month (its wiped once three decades).

Once we earn more, this new amount becomes bigger, and you can the attract keeps ascending but most folks is actually merely treading drinking water (of many need to secure ?sixty,000 a-year so you can breakeven to their harmony). Yes, you might not be able to pay it back, claims Ian Dempsey, economic adviser at the TheMoneyMan.

It generally does not appear on my credit score, I can not enter arrears, the latest bailiffs doesn’t turn-up within my doorway if i reduce my personal business and prevent paying.

Today, I am aware having so it debt isn’t the just like which have ?sixty,000 into the unsecured debt handmade cards, like

But, it isn’t while i accept is as true try marketed so you can all of us naive teenagers versus impact. It will impact the most other huge monetary millstone in the millennial neck the capability to score a home loan.

The fact is that their mortgage depends on the terrible income and you will everything possess developing [of these], states Dempsey. Generally, financial organizations will appear at the a debt-to-money proportion. The general maximum is actually thirty six percent away from loans compared to the that which you take-home just what you’ve got coming in. For those who have forty percent, that could be a red-flag.

In short, which have a huge amount of paycheck heading to your payments every month have a tendency to apply to exactly how much you might borrow to own a mortgage, since you won’t have an identical income, post-tax, once the individuals versus a student-based loan manage. And you will, it will feeling how much cash throwaway income you must place into rescuing getting a deposit.

Comprehend 2nd

The banks very tightened up [evaluating loan value] after the right back of your financial crisis. The loan distribution review, implied you to definitely deposit, credit history, income, plus facts try appropriately taken into account into the a home loan financing, states Dempsey.

The state position inside it is you have to declare how much you pay towards the student loan. Nevertheless the threshold you are spending they back from the will be considered, that is in your payslip.

You will find one silver liner it isn’t the total amount of loans that is sensed from inside the the mortgage calculation, as an alternative the quantity appearing out of your own income per month. Funmi Olufunwa, an experienced individual fund attorney, financial agent and you can Inventor of monetary degree vendor, Hoops Loans, says: We have never ever understood a loan provider to inquire of with the full matter of pupil financial obligation.

But that is the spot where the positives prevent. Such large bills is actually an enormous weight within the shoulder from young people, Dempsey says. We seen absurd rising prices usually, which is the reason why these costs have remaining up.

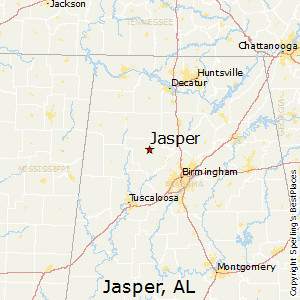

You think after that that amount is unimportant, in the event the at some point it will be cleaned anyway as i arrived at my fifties? Exactly what it indicates is the fact that power to https://paydayloanalabama.com/gadsden/ acquire a great deal more inside center-many years will never be accessible to myself, in the same manner it is to people with Package 1 fund just who be able to repay their credit.

In the event the rising cost of living continues to perception college student financial obligation, I am seeing attention-watering money for many years. If i choose to go in order to college or university just a few age earlier, I might are located in that have a chance of cleaning you to definitely debt in my own thirties.