You started the method to buying property. You’ve fulfilled their bank as well as have come preapproved. You’ve selected property together with provider has recognized the offer. You may be on your way to help you living in your household there can not be numerous difficulties, right?

Tend to, this is certainly correct. However, when economic activities change between your day youre pre-accepted for a financial loan plus the go out your theoretically close for the your loan, the road to purchasing a home might be slowed or completely derailed. That is why it’s important to ensure that discover zero major alter on profit during this period.

Prevent Making an application for Other Finance

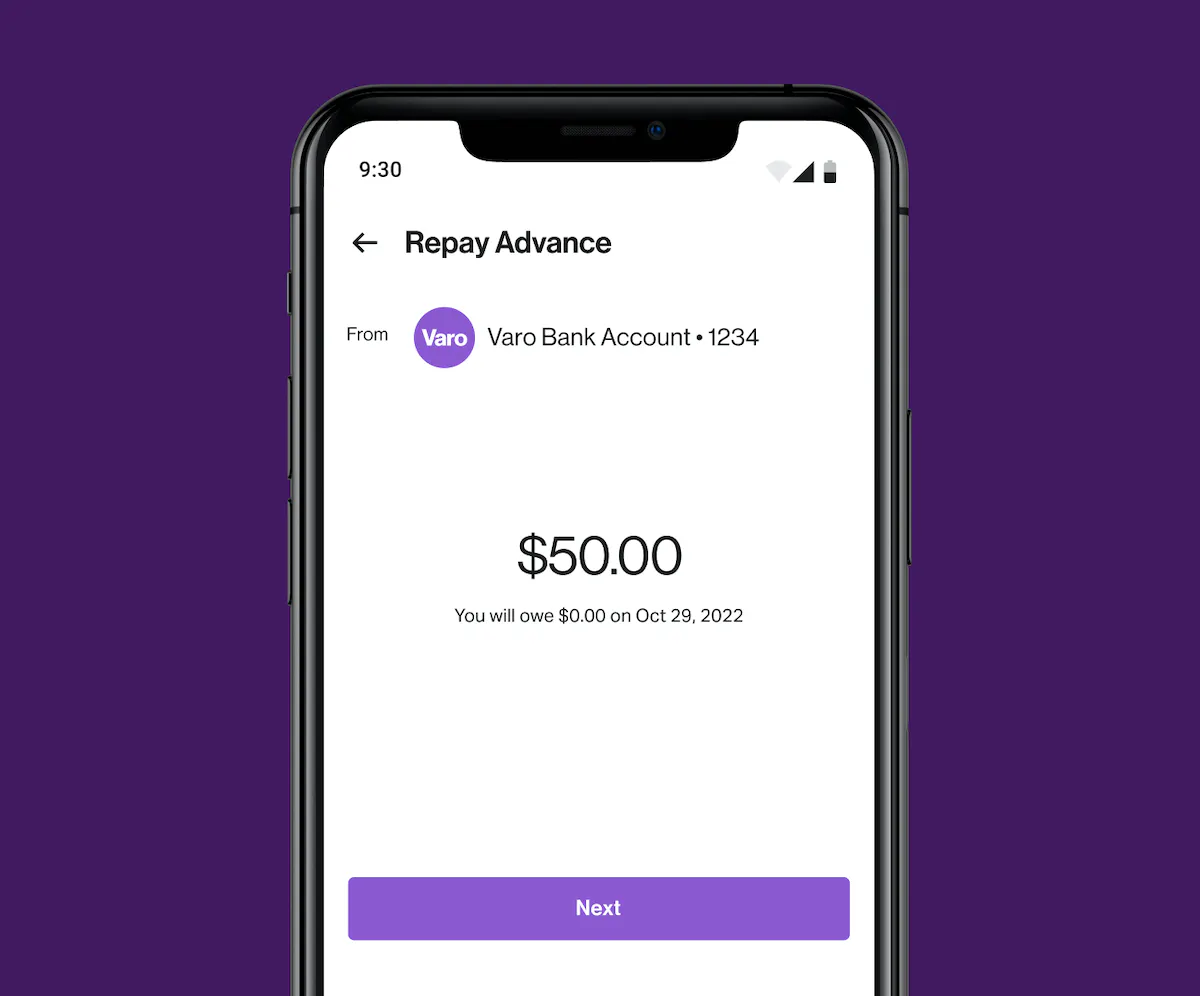

You will want to stop applying for other financing (together with payday loans), starting another line of credit (such as a charge card), otherwise cosigning toward a loan. Most of these issues will be on your credit history. Your own bank will discover the rise indebted and necessary monthly costs. They may influence that your particular power to make costs on your own Bayou La Batre loans brand new real estate loan consult changed.

The above products have a tendency to connect with your credit rating. They also require you to definitely work with a credit check on you, which action in itself might even apply to your credit rating. Since your credit history find their home loan rate or you meet the criteria for a loan, it is best to conserve this type of transform to possess after.

Prevent Late Money

This can both alter your credit score and provide crucial evidence toward financial that you are able and then make payments. Imagine and work out automated costs.

End To purchase Big-Violation Circumstances.

You will want to stop steps which could notably elizabeth. It indicates waiting to pick big-admission items such as for example a car or truck, vessel, or furniture until once you have completely closed in your mortgage loan.

To prevent Closing Credit lines and And come up with Highest Cash Deposits

You would imagine closure credit cards otherwise deposit a large amount of money works in your favor. However, closing a credit line eg a charge card your thought it impacts your credit rating. Even if you don’t use the financing card, evidence that it is present, and also you have not tried it irresponsibly may benefit you.

At exactly the same time, a large, uncommon dollars deposit might look doubtful. It entails a loan provider to-do lookup towards perhaps the money was a cash loan available with a buddy or if perhaps the fresh new unforeseen increase is also genuine.

Prevent Changing Your job

Stopping otherwise modifying work will most likely suggest a general change in money. Getting greatest or worse, the alteration commonly effect their home loan software. Rescue it existence change to own once you have signed into the mortgage, otherwise at least, get in touch with their lender to discuss how that it alter could apply at your loan.

Stop Other Huge Monetary Changes

Now could be perhaps not the time to evolve finance companies. Should this happen, your financial would need to delay the mortgage procedure in order for they may be able collect many latest files from the the fresh bank.

Keep Financial Informed off Inevitable Life Transform

Such as, if you are planning to acquire partnered inside financial process, make sure your bank understands. As to the reasons? Your wife would need to sign the loan, even though they aren’t an element of the mortgage.

If you intend so you’re able to legitimately change your name, it’s also wise to wait until once you’ve signed into the mortgage. Brand new difference inside the brands into other data could slow down the process.

Correspond with their Bank or Representative

While the significantly more than seems like a lot, referring to only to prevent any major economic alter up to once you’ve finalized on the loan. If you’re ever being unsure of, pose a question to your financial prior to acting.