Old-fashioned Mortgage

Antique finance may not look like a choice but products like HomeReady simply need step 3% down. Some things to remember ‘s the credit ratings requisite try highest together with a credit score and understanding that lower down-payment and you will probably also be necessary to shell out PMI.

Private Creativity Accounts

Individual Creativity Accounts or IDA’s have been built to let some one help save to possess things such as creating a corporate, knowledge, and buying a house. Such formal bank accounts try deducted from your own paycheck – pre-tax – and you can matched by the nation’s Temporary Direction getting Desperate Parents (TANF) program. There are several requirements so you’re able to qualify thus be sure to review those people directly.

Offers

There are a number regarding grant applications readily available built to help unmarried moms and dads seeking to pick a property. So when a reminder, grants is actually monetary benefits that aren’t fund – definition it’s not necessary to outlay cash right back. These features can offer things like a portion of your complete loan amount, an such like. so definitely lookup those in your neighborhood understand this new qualifications clearly.

It may be economically tricky adequate in a-two-mother or father home so it’s simple to rating discouraged since an individual mom if you find yourself speaing frankly about a single income. But not, being practical regarding the property means and you may staying with your financial budget will assist with your odds. Additionally, there are lots of things that change your probability of approval and also make the process go effortlessly whenever making an application for any one of these types of fund, though.

Borrowing

No matter which mortgage you consider, your credit rating is going to play a cause of a good mortgage lender’s s take on straight down scores – really imagine a credit score that have an effective “Good” get are around 670. The higher you can get your get, the higher conditions you can purchase. Ensure that your costs are paid down promptly while comment your credit report when it comes down to inaccuracies otherwise forgotten debts to pay off all of them up.

Debt-to-Earnings

Your own DTI otherwise personal debt-to-income proportion considers how much cash of earnings is actually burnt to repay expenses. Loan providers look for a prospective homeloan payment that’s no more than 28% Alaska personal loans of one’s overall gross income and you will shouldn’t meet or exceed thirty six% if remainder of the money you owe such as for example figuratively speaking otherwise credit cards repayments was added in the.

Advance payment

A number of the benefits associated with these-mentioned programs are lower in order to zero down payment conditions. Though some programs could potentially disqualify your for having a down payment, anybody else could offer even more positive terms if you can provide higher than necessary down costs, letting you borrow faster and you may reducing chance towards the lender.

Evidence of Income

Enjoys paystubs with a minimum of thirty day period prepared to tell you a beneficial consistent income and you can W-dos forms for at least during the last 2 yrs if not a whole lot more. When you’re self-functioning, you will need to render more documentation so be sure to prove by using your loan officer.

A number of Possessions and you will Costs

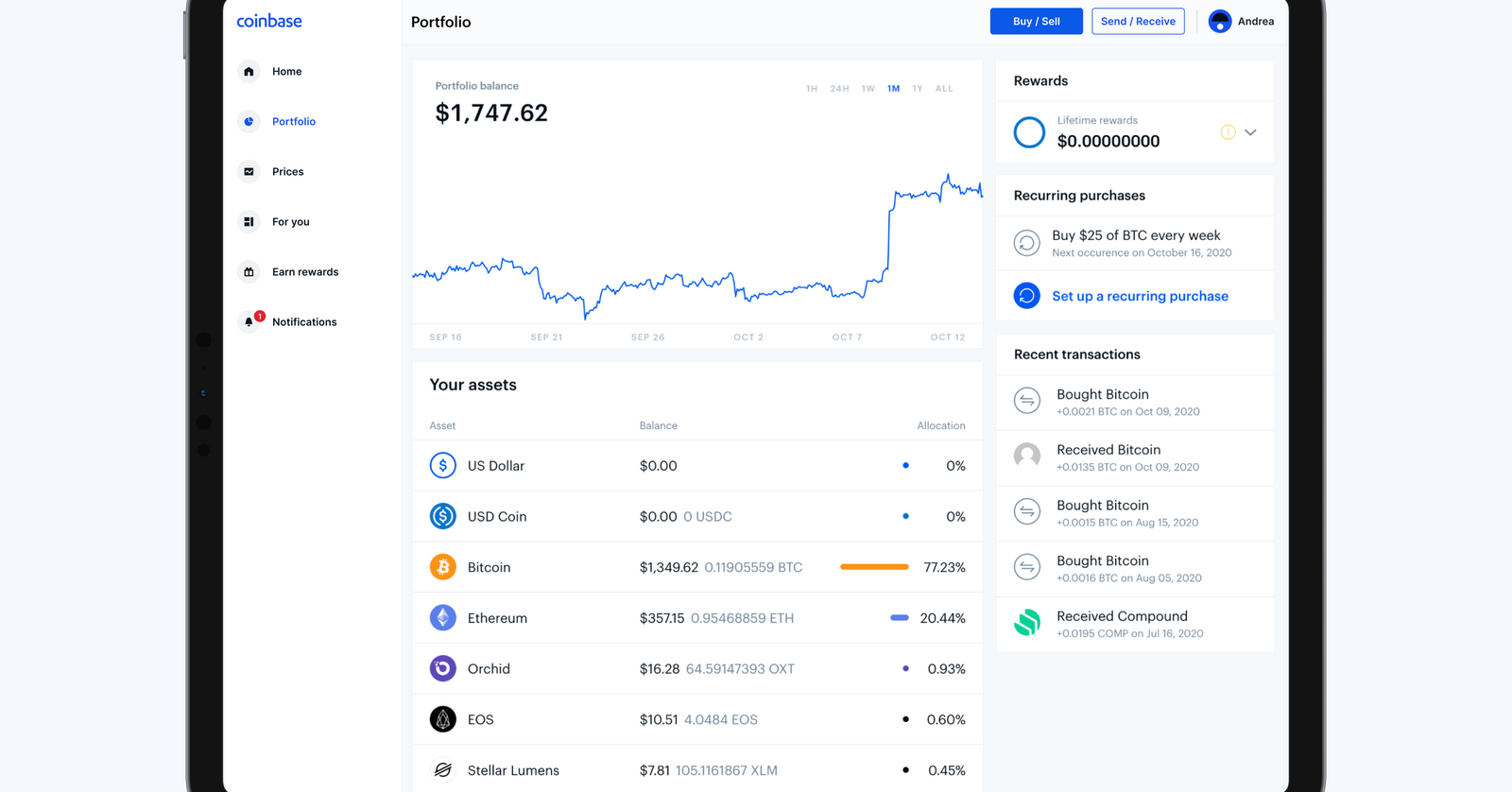

Records of your own bank, investment and you may advancing years levels will likely be prepared to establish also since the one info away from costs like car loans, playing cards, and you will education loan balances.

More Economic Records

If you were provided hardly any money to help with the purchase out of a home, you need a gift money page. You can even feel wanted leasing record and you may facts about a divorce or separation decree, an such like. The bank otherwise grant recommendations should provide this info.

Why must a single mommy want to make use of assistance with good home loan and not ask loved ones otherwise relatives?

Repeatedly, a borrower really wants to end up being as if they are able to make their house purchase centered on their own merits, here’s what tends to make taking a great co-signer such an individual decision. There is caused loads of unmarried mothers you to state some thing particularly, “I understand delivering a great co-signer is actually an option, however, I want to exercise on my own”. It generates them getting a great deal more motivated discover recommendations rather than ask household members or family relations and is really well okay!