5. Plan out The Possessions

Anyway, you want him or her to suit your advance payment, settlement costs, and for supplies, the latter where reveals the financial institution you really have money in order to free, otherwise a support if the circumstances change.

You’re generally speaking expected to provide your own history a few months out-of financial statements to exhibit the lender a cycle of saving cash.

While making existence easier, it may be prudent to help you put every requisite financing in you to particular account over a few months in advance of application.

In that way the bucks will be experienced and there will not be the necessity for factor characters in the event the money is always planning and out of the membership.

An appropriate condition could well be a protecting account utilizing the needed finance and hardly any interest over the past ninety weeks.

6. Think of Any Warning flags

Resource affairs are often warning flags to possess financing underwriters. They hate observe money that has been simply transferred to your account, since the they have to provider it and find out if it is seasoned.

Same applies to current large dumps. They should remember that it’s your money rather than a great gift or that loan out-of others because wouldn’t commercially become your money.

Attempt to believe eg an underwriter right here. Make certain that property come in the membership (perhaps not your spouse’s or mothers) far ahead of time and that it is sensible predicated on exactly what you will do getting an income/earn.

Together with capture an arduous look at your employment history. Will you be in the same job or collection of works for around 2 years, can it be stable, one current change?

Any unusual posts going on with any financials? In Kingston installment loans this case, treat it physically up until the bank do. Exercise the kinks just before providing the underwriter this new keys to their file.

And do not forget to get an effective pre-qual or pre-acceptance merely to see where you stand. You can have a specialist search free of charge having no obligation to use him or her once you extremely pertain.

We find it throughout the day a loan administrator or representative tend to essentially place a borrower inside the a particular variety of financing in place of a whole lot as the asking what they’d such as for instance.

Not every person wants or demands a 30-12 months fixed financial, regardless if it is and you can aside widely known mortgage system around.

8. Thought How much time You are at your home

Once you know or have an idea how much time possible contain the property, it can be important in the loan alternatives.

Such as, once you know you may be only to buy a beginning house, and get fairly strong plans to move around in five years otherwise quicker, an excellent 5/step one adjustable-rate home loan would-be a better selection than just a 30-year fixed.

It may help save you a lot of cash, many of which is lay with the this new down-payment towards your move-up assets.

nine. Know Mortgage Costs

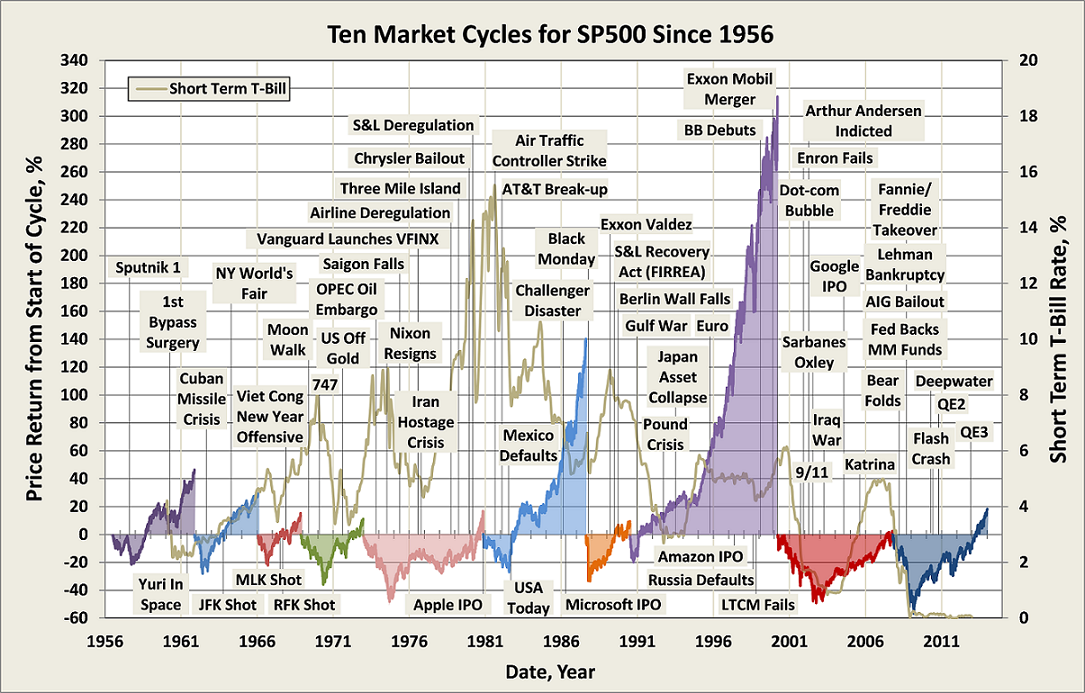

This option pushes me crazy. People simply advertises rates without outlining him or her. Where manage they come up with him or her? Exactly why are they more? How come they go up and you will off?

Talking about all-important concerns you have the brand new answers to. Yes, you don’t need to getting a specialist as it can score fairly difficult, but an elementary knowledge is vital.

This will affect the types of financing you decide on, if you decide so you can secure their mortgage rate, if in case you’ll shell out disregard issues.

If you are just evaluating cost regarding various other lenders, maybe you is always to take the time to best understand the requirements while you’re at it.

This can help that have settling cost also, given that a knowledgeable borrower who knows the borrowed funds terminology gets a less complicated date to make a case whenever they end up being they have been getting recharged excessively.