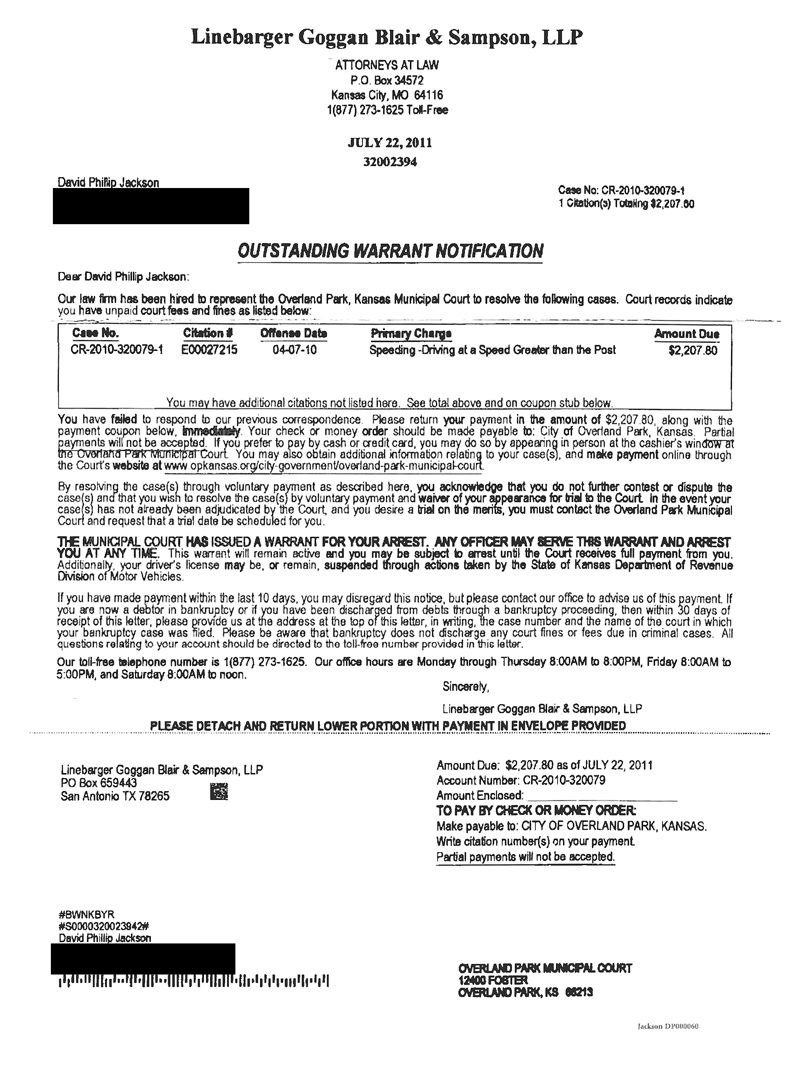

On the $28 billion out-of improves regarding Government Mortgage Bank operating system

Assets: Bonds worthy of regarding the $29 million; finance which have a face value around $173 billion however, an industry property value throughout the $150 million; bucks of about $fifteen million; other stuff really worth from the $nine billion; getting a total of throughout the $227 million from the pre-bargain accounting philosophy however, just $204 million out of real really worth.

Liabilities: Dumps of approximately $ninety-five mil, of which $5 mil originated from JPMorgan and you may $twenty five mil came from a small grouping of most other larger financial institutions, whom put their money on the Basic Republic in age away from normal depositors. Throughout the $93 million away from small-title borrowings on Government Set aside (dismiss screen and you may Bank Title Capital Program). Men and women about three debts – so you can depositors, to the FHLB, for the Provided – actually want to be paid back, plus they enhance on the $213 mil. First Republic got additional debts, and additionally a bit less than simply $step one billion off subordinated ties, however, why don’t we ignore the individuals.

Assets: JPMorgan ordered the financing and you may bonds, marking all of them in the their market value, about $30 mil for the securities and you may $150 mil into financing

Equity: The publication worth of Very first Republic’s equity yesterday are something like $eleven billion, including on $4 million from well-known inventory. The actual property value its equity try bad, though; their full assets regarding $204 mil, during the market value, was in fact below this new $213 billion they due so you’re able to depositors, new Given as well as the FHLB, never mind its other financial institutions.Listed here is, about, how purchases did: