What will happen to my loan in the event the my personal crypto security falls in the really worth?

Bringing every thing within the? Down load a perfect Guide to Crypto-Supported Financing and now have it available for future resource.

Crypto fund and you will margin phone calls

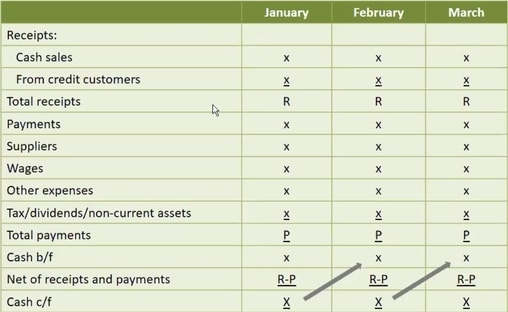

One to critical aspect of crypto finance ‘s the risk of margin calls. Should your value of the crypto equity drops significantly, the lending company will get matter a beneficial margin name and need one put extra collateral to maintain the newest agreed LTV ratio. If you fail to do it, they may liquidate the equity to purchase loan.

Envision a situation for which you sign up for an effective $10,000 loan backed by 1 Bitcoin (BTC) as security. In the course of the loan, the price of Bitcoin are $30,000, causing an initial Loan-to-Well worth (LTV) proportion out-of %. This might be calculated of the isolating the loan number because of the really worth of equity and you will multiplying of the 100.

However, if for example the cost of Bitcoin drops in order to $20,000, the worth of the guarantee minimizes to help you $20,000. Thus, the newest LTV proportion increases so you can 50%, once the loan amount continues to be the same because the property value this new equity enjoys decrease. The fresh new LTV proportion is student high school loans for bad credit additionally calculated of the splitting the borrowed funds number of the new property value brand new equity and you may multiplying because of the 100.

An increase in the newest LTV ratio indicates greater risk into the lender since the security has started to become worthy of shorter prior to this new amount borrowed. (suite…)