Do i need to make use of very early the means to access superannuation hand-in-hand for the Program?

Stamp duty rescue can often be so much more ample. When you look at the NSW, such, this really is available on home coming in at as much as $800,000 (complete different with the characteristics costing around $650,000). The value of this exclusion to own an effective FHB to acquire a beneficial $650,000 home is $21,000.

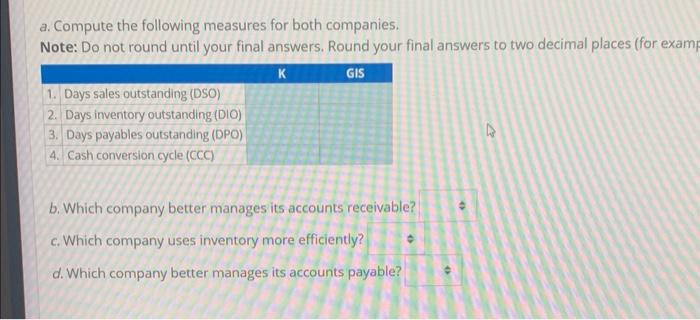

Under the FLHDS someone may access home ownership with only 5% deposit payable. In the Questionnaire, a diminished quartile charged property now costs you $570,000. Good 20% put on that would-be $114,000. Whenever you can get a mortgage having a deposit out of merely 5% which is lower than $29,000 a less number might need certainly to save your self. This would cut waiting date: maybe 2-3 years toward average FHB, maybe not a decade. In addition, it preserves FHBs currency they’d otherwise pay towards home loan insurance coverage: regarding $24,000 along side life of home financing if the financial is prepared to give the loan within these terminology.

Nevertheless the the brand new design is only guaranteeing element of your loan, not paying for this. You nonetheless still need to meet up with the payments toward a beneficial 95% mortgage to suit your entry level house. (suite…)