Step four: Search for forget the assets to make an offer

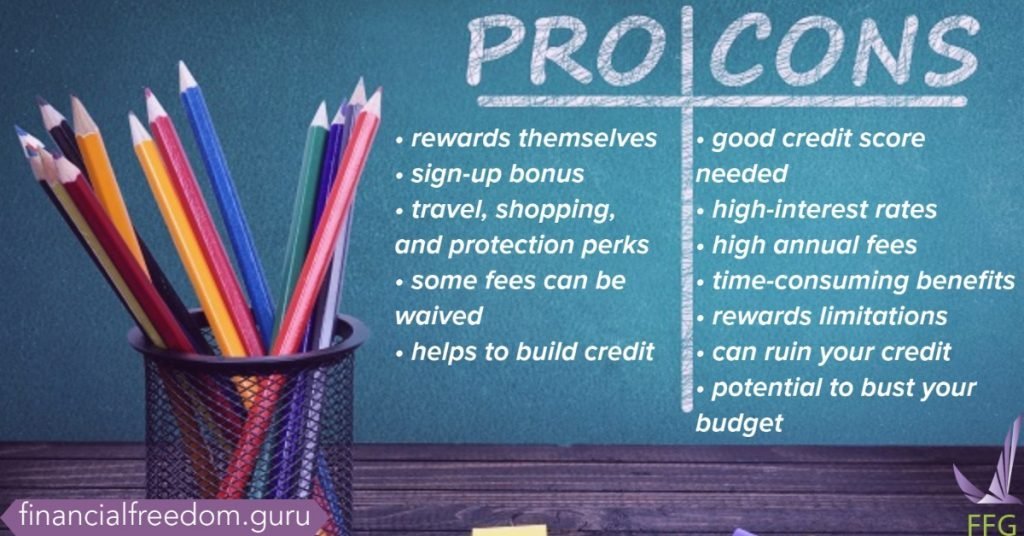

Score financing pre-acceptance out of a loan provider knowing your own restrict amount borrowed and you may let you know providers you may be a serious customer. Inside the pre-approval process, a lender assesses your financial situation and you can creditworthiness to decide the limit loan amount and offer a good conditional connection for resource.

3: Prepare your mortgage files

Gather expected data, such as for example proof money, bank account, financial statements, identification, tax returns, and borrowing from the bank profile in your country out of provider, to help with your loan app.

Look for suitable funding characteristics affordable to make a keen provide toward one that best suits your own criteria. You claims of many foreign buyers imagine were Washington, Colorado, Florida, Illinois, and New york.

Step 5: Mode a good You organization such as a keen LLC

Present a beneficial Us-based entity, for example a limited responsibility business (LLC), to hang this new money spent and gives responsibility coverage. (suite…)