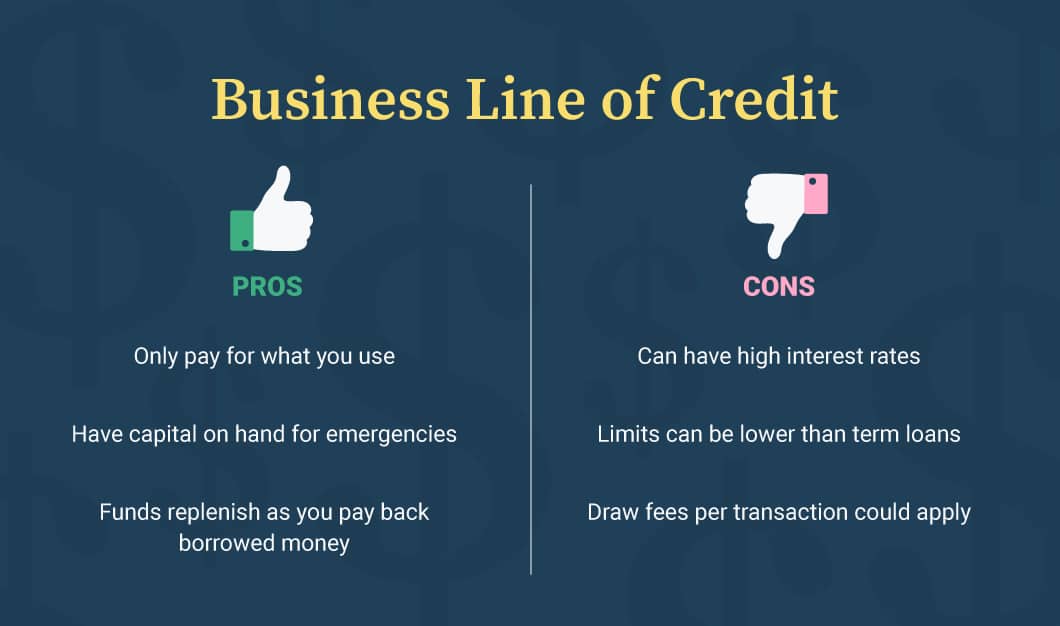

The reduced monthly obligations including provide bucks buying possibly highest-yielding potential

If you’re facing the selection anywhere between a great fifteen-year and you will a thirty-year financial, you may find on your own caught anywhere between a couple financial heavyweights which have most other outlooks: Warren Buffett and you can Dave Ramsey. Its contrasting suggestions has the benefit of a glimpse to the wider arena of private fund, where in fact the correct selection depends as often on your disease as towards experts’ information.

Referring about what your really worth significantly more: the safety from paying your home fundamentally that have a beneficial 15-12 months financial or the freedom and you will funding possible out of a 30-year financing

- Warren Buffett immediately following said, “If not are able to make money while you bed, might functions if you do not die.”Such highest-yield a property notes that pay eight.5% 9% make earning passive money smoother than before.

Warren Buffett, the new legendary buyer noted for flipping currency into the extra cash, after picked a thirty-12 months home loan towards the a beneficial $150,000 coastal property. That may seem shocking for an individual with his riches, however, Buffett had plans. The guy noticed the bucks conserved towards the monthly installments could be best invested in other places such as Berkshire Hathaway shares, and this, because looks like, is actually a so good suggestion. (suite…)