Can i Get a good USDA Mortgage from inside the Corpus Christi?

Borrowing from the bank Recommendations and you can Credit history Requirements

USDA funds possess rather flexible borrowing from the bank guidelines, and you may be eligible which have a credit score as reasonable because the 620. Although not, you will need to observe that the interest rate might possibly be large in case the credit score are below 680.

Where is actually USDA mortgage brokers available?

USDA lenders appear in 97% of the United states, together with Corpus Christi. The house or property must be based in a selected outlying city inside the buy in order to meet the requirements. To get considered “rural,” a location typically has a people away from thirty-five,000 or faster.

Outlying development loan

USDA finance are mortgage loans supported by the You.S. Institution out of Agriculture included in their Rural Innovation Secured Housing Financing system. USDA finance are available to home buyers that have reduced-to-mediocre money. They supply investment without down payment, smaller home loan insurance policies, and less than-business mortgage rates.

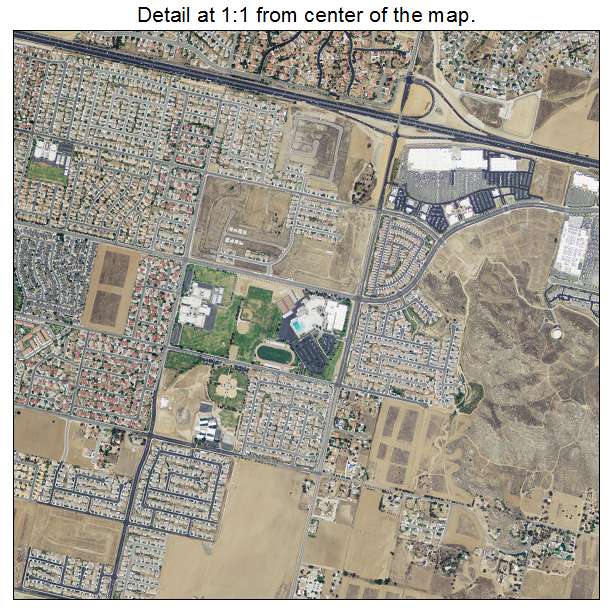

Qualified town map and Outlying section

The brand new USDA enjoys designated certain specific areas as “rural” for the purposes of the loan program. You can check out the latest USDA web site to find out if your house is found in an eligible town.

Are produced land and you may solitary-members of the family land

USDA money can be used to pick each other are manufactured land and you can single-family unit members property. But not, you will find some constraints one to implement. Are formulated homes have to be brand new, and they have to be permanently attached so you’re able to a charity. (suite…)

:max_bytes(150000):strip_icc()/bank_176952073-5c797c5446e0fb00011bf2e4.jpg)