From 1970 to help you 1989, People in america stored over nine percent of its personal earnings

On the other hand, much more research is offered from the millions of a failure mortgagors (subprime, A beneficiallt-A great, and/otherwise finest), it is almost apparent one specific part of the state — perhaps a life threatening part — may stem from “predatory credit,” recognized as a transaction where debtor convinces the financial institution in order to lend excessive. Because underwriting criteria e obvious to numerous about a home team, people got benefit of new lax conditions purchasing belongings that they could not if not pay for, to re-finance home to find almost every other individual durables or reduce personal credit card debt, or perhaps to purchase residential property for financing (leasing or attempting to sell) without discussing that the residential property just weren’t the no. 1 residences.

Moreover try the latest growing proclivity to utilize a beneficial second financial to invest a downpayment to help you a keen unwitting first home loan company — primary or subprime — towards lender believing that the fresh new borrower had no other high debt obligations.

Sometimes, new expanding accessibility lowest- if any-papers mortgages (either titled “liar financing”) greet men and women to go overboard the profits and located money which they were not entitled to

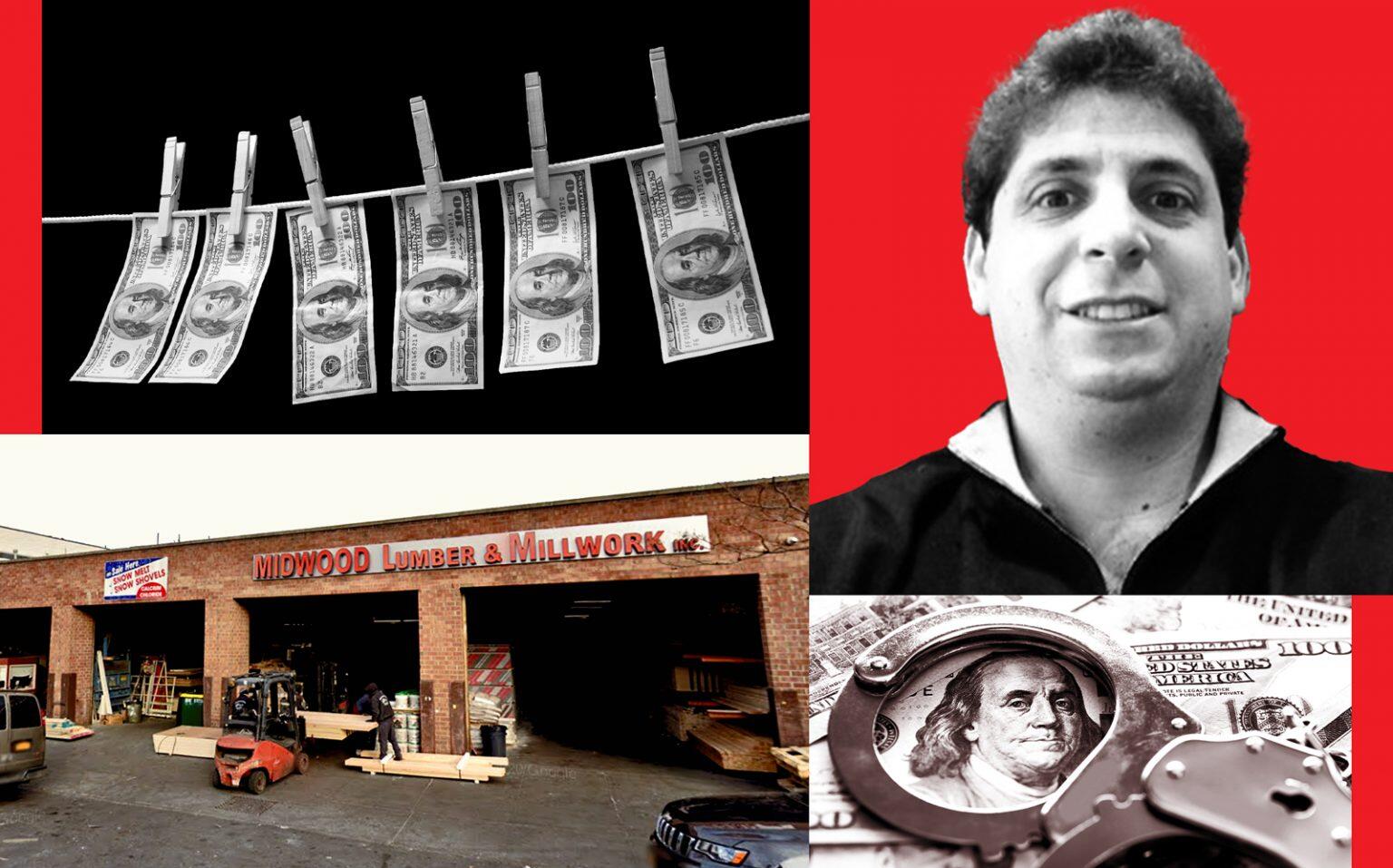

A version out of predatory borrowing from the bank ‘s the apparently naive and you can unwitting borrower who’s victimized because of the an organized mixture of a property buyers, appraisers, agents, and financing officials whom mix to market expensive belongings so you can unqualified consumers to make big profits, fees, and you may financing growth of the misrepresenting the new borrower’s certificates. (suite…)