Contents:

Inside days refer to a candlestick pattern that forms after a security has experienced daily price ranges within the previous day’s high-low range. That is, the price of the security has traded “inside” the upper and lower bounds of the previous trading session. It may also be known as “inside bars.” Inside days may indicate consolidation or lower price volatility. It can be a great indicator of price consolidation and potential reversals.

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

Check later during the day to see which pending order was activated then cancel the other that was not activated. If you trail stop your trades to lock in profit as shown in the previous chart above, you can make a lot of profit if the trend is strong. Avoid trying to use smaller timeframes to trade inside bars, there will be too many “noise” and false signals. The second candlestick that forms after the “mother candlestick” is engulfed completely within the shadows of the mother candlestick. Hypothetical performance results have many inherent limitations, some of which are described below.

Powerful Techniques to Determine Forex Trend Strength in 2023

The two-https://g-markets.net/ pattern is made up of two strong bars closing in opposite directions. A key reversal bar is a particular instance of a reversal bar that shows clearer signs of a reversal. For the bearish pattern, the market met resistance above the high of the previous bar. Furthermore, the resistance was powerful enough to cause the current bar to close lower. As for stop loss, an order could be placed at the lowest price level of the mother candle or at the lowest level of the previous price swing .

To spot this inside bar forex on your chart you are looking for three candles. The major difference between the double inside bar and the inside bar is that the double has two inside bars form back-to-back. There has to be a well-established trend; bullish or bearish.

Inside Bars as Reversal Patterns

It is the most widely used candlestick pattern and there is a clear logic behind this pattern. It can make you a profitable trader if you will use it in the correct way. With its long tail, a pin bar breaks a support or resistance momentarily to trick traders into entering the wrong direction. These traders are trapped, and there is often money to be made when you find trapped traders. By definition, key reversal bars open with a price gap. As gaps within intraday time frames are rare, you will find most key reversal bars in the daily and above time-frames.

When you see an inside bar form, then place a sell stop order anywhere from 2-3 pips below the low of the inside bar. The trading room is for educational purposes only and opinions expressed are those of the presenter only. All trades presented should be considered hypothetical and should not be expected to be replicated in a live trading account. Bar patterns represent just one aspect of a price-based trading plan. However, while the inside bar shows no strength in either direction, the NR7 pattern might drift upwards or downwards.

For the sake of order, let’s assume that we will call today’s two patterns as pin bar and inside bar trading strategies. Another simple price action strategy is looking to take advantage of an impulsive candlestick. While there is a certain amount of flexibility in defining what an impulsive candlestick is, I look at it as a candlestick that is much bigger than any of the preceding three candlesticks. This shows that there is an impulsive move in one direction or the other, and therefore momentum is increasing. Ranging markets due to the lack of liquidity and the reduction of traders’ participation. Hence, we can consider the inside bar as a trend continuation signal and a reversal signal alike.

I’m especially fond of using this signal when trading breakouts. In technical analysis, when market makers try to make big decisions, an inside bar candlestick pattern forms on the chart. It is a symbol of indecision in the market and shows the upcoming trend reversal.

#4: Inside Bar Trading Strategy

All this is in expectation of the price breaking out to form a new high or low beyond this point. Another way to place them would be near the 50% level of the mother bars . Remember to use smaller or tighter stop losses, in case the mother bars are not too big. Smaller mother bars signify greater chances of breakouts. Once these two conditions are satisfied, traders can find good positions for entries. Before deciding to trade on inside bars, we have to wait for the daily close and observe if the highs and lows of the inside bar are within the range of the first candle.

Money Laundering Tricks Include Gold Bar Imports and Forex … – Jakarta Globe

Money Laundering Tricks Include Gold Bar Imports and Forex ….

Posted: Thu, 30 Mar 2023 00:01:00 GMT [source]

Identification of this candle pattern is pretty simple and easy. If you understand bullish and bearish engulfing candle pattern then you can spot it right away. Visually, the body of both candles helps you identify the pattern. The inside bar setup is capable of producing consistent profits, but only to the traders who mind the five characteristics discussed above.

Stop-loss when trading inside bar patterns – we know that a stop-loss strategy is recommended for any forex strategy. Where you place your stop-loss in an inside bar pattern depends on the direction of the break. If the inside bar range gets broken upwards, then you should put the stop-loss order right underneath the lower candlewick of the inside candle.

You can look to short and have a sell stop order on the lows, and stop loss above the high of the first bar. If I want to go short, my sell stop will be below the low of the larger bar. How I look to trade it, is that if I have a long bias, I would see the highs of the previous bar, this is where my buy-stop order will be. So, I’m going to share with you how I enter the inside bar trade.

What does an Inside Bar look like?

It may be that you just haven’t learned how to trade — how to manage risk and random outcomes. I designed this course to turn amateurs into PROFESSIONALS and make struggling tradersCONSISTENT. Other tips and rules should also be considered when trading inside bars. We will begin by describing a little more about an inside bar pattern and then move on to trading with it.

If you are a fan of pure price action Forex trading using candlestick patterns, then this lesson will be of particular interest to you. Today we will discuss a powerful candlestick formation which can often precede a sharp price move. 64% of retail investor accounts lose money when trading CFDs with this provider. This price reversal occurs even though the pair was trending up in value, exhibiting multiple signs of a profitable setup. The risk of a price reversal has to be accounted for whenever you’re trading on inside bars.

This is why a stop-loss is so important to building a sustainable trading strategy. Inside bar trading is also relatively easy to use when analyzing trade opportunities. Because this approach is best utilized on daily charts, you only need to check charts once a day to look for inside bar opportunities.

How to Trade the Inside Bar Pattern – DailyFX

How to Trade the Inside Bar Pattern.

Posted: Tue, 03 Sep 2019 07:00:00 GMT [source]

The difference between an inside bar and harami is that with an inside bar, the highs and lows are considered while the real body is ignored. In essence, you are looking for places where the price has failed to break above or below and take advantage of the “market memory” in that area. This would include numbers such as 1.30, $15.00, $10.00, 2.00, etc.

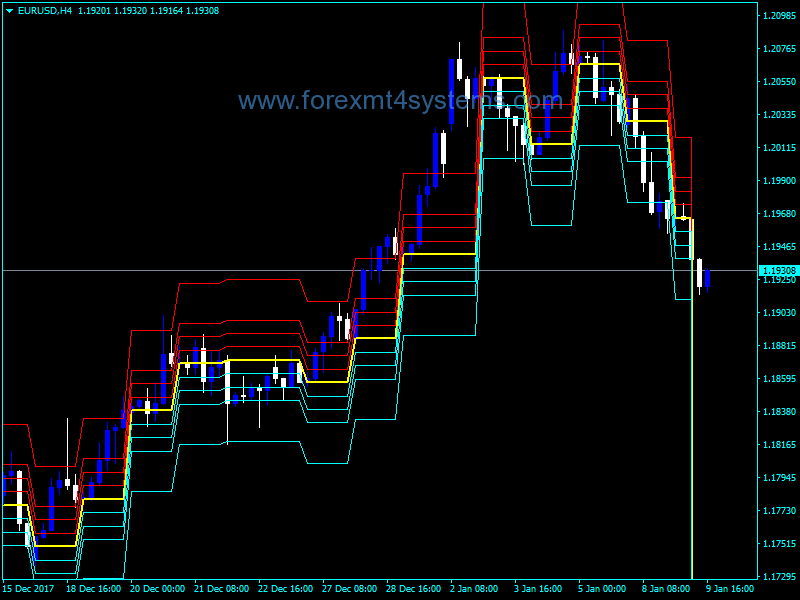

Nial, I don’t know what I can call you now because all your break down those hard, thousand-dollar forex trading book and renders them useless. The blue circle on the image points to the inside day candle. Also take note of the three blue arrows at the left side of the image, which shows that the previous three candles on the chart are actually bigger than the inside candle. Therefore, we confirm that the inside candle is also the narrowest range day of the last 4 daily sessions. It is consolidating because the bulls cannot manage to create a higher high and at the same time the bears fail to create a lower low. As such, there is not sufficient buying or selling pressure to break the previous bar’s high or low.

Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. Now it is your turn – open your charts, analyze Inside Bars, supports and resistances, the main trend of a market, and explore how you can make some nice profits by trading the Inside Bar pattern. Now we will examine the inside bar forex trading strategy. Inside bar is a graphic pattern whose body is located inside the previous bar. Investors haven’t been sure whether or not the previous price movement will continue and they’ve taken a pause.